- Moving the markets

The market was eagerly waiting for Nvidia’s earnings report, which is due out later today. The chipmaker was expected to post impressive growth in both profit and revenue, thanks to its dominance in the artificial intelligence (AI) sector.

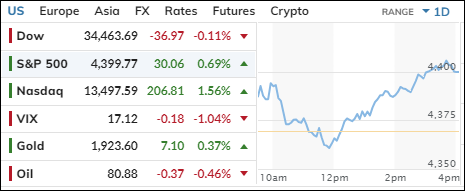

The bulls were optimistic and pushed the major indexes higher, while the bears took a back seat. The lower bond yields also helped boost the market mood, as the 10-year Treasury yield fell to 4.18%, down from 4.33% yesterday.

However, not everything was rosy in the market. The rally this year has been driven by a handful of AI stocks, leaving many others behind. The manufacturing sector has been weakening, while the consumer spending has been surprisingly strong. These conflicting signals have created confusion and uncertainty among investors.

The bad news continued to pile up today, especially for the retailers. They reported disappointing results that showed a more-stressed American consumer than the market had anticipated. This was the worst week for retail earnings since April, according to the Citi Economic Surprise Index.

The dollar dropped on the gloomy outlook, while gold rose over 1%. Crude oil also slipped, as demand worries weighed on prices.

In the individual stock universe, the bears had a field day. Peloton plunged 23%, as it faced lawsuits and recalls over its treadmills. Footlocker had its worst day ever, as it missed earnings and revenue estimates. Nike extended its losing streak to 10 days, as it faced supply chain issues and boycotts in China. Nvidia was one of the few bright spots, as it bounced back ahead of its earnings tonight.

The earnings report from Nvidia is critical for many reasons. It would determine the fate of the AI boom or bust scenario, as well as the direction of the broader market. Nvidia is seen as a bellwether for the tech sector, and its performance could have ripple effects on other stocks. Investors are hoping for a positive surprise from Nvidia, but they also know that expectations are high, and anything less than stellar could trigger a sell-off.

Read More