- Moving the markets

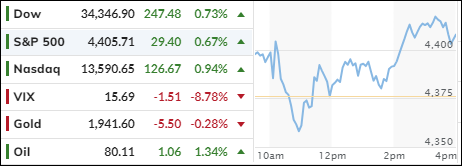

The markets tried to shake off their August blues by betting on bad news. The Labor Market showed signs of a slowdown, with fewer job openings and lower revisions. The US Macro Data index also dropped for eight days in a row.

Some analysts feared a hard landing recession, but Wall Street traders saw a silver lining: the Fed might cut interest rates sooner and more aggressively. The hopes for lower rates were boosted by falling bond yields and weak Consumer Sentiment data. The market expectations for Fed rate changes reversed course and ignored Powell’s hawkish stance.

The rally was also fueled by a short squeeze, as the bears had to cover their positions. Nvidia soared above its pre-earnings highs before losing some steam. The dollar took a dive and posted its biggest loss since mid-July. Gold shone and jumped almost 1%.

I think the market volatility in August is not over yet, and I expect more swings in September as the market adjusts to a slower economy. The Fed’s past rate hikes have taken their toll on the economy, especially on the housing market, which faces higher mortgage rates.

Read More