I am about 70% through reading Thomas Friedman’s book “The Word Is Flat.” It’s a fascinating research project about how the world has become a totally interconnected place where every businessman can utilize the resources and services of anyone else.

I am about 70% through reading Thomas Friedman’s book “The Word Is Flat.” It’s a fascinating research project about how the world has become a totally interconnected place where every businessman can utilize the resources and services of anyone else.

He specifically hones in to the special relationship the U.S. enjoys with India. I was astonished to learn how many businesses outsource services and tasks to Indian companies. That includes major banks, Wall Street firms, tax preparers, computer manufacturers and many others.

There are several reasons for this affinity. Bangalore, India has developed a massive infra structure of domestic Indian companies that are all set up to service U.S. based businesses. For example, if a Wall Street firm needs to have a presentation project done, they can simply upload the details at day end Eastern Time to a service in India specializing in that sort of thing and have it back in their e-mail inbox by the next morning.

Because of the time difference to India, they work while we sleep. Of course, there are many service firms that work 24-hour shifts to allow for simultaneous work interaction with the U.S.

The only reason this is possible is because India has an extremely well educated, bright and English speaking work force that is eager to work. The pool of resources, Friedman says, is absolutely enormous. Indians get paid a very good wage to work for an outsourcing company, and it is a well respected position.

For an American firm, it’s a no-brainer. You get an equivalent of an MBA or in some cases even a PhD, who will work for an hourly wage that is considerably less than what they would be paid here in the U.S.

To verify that information, I contacted some of the outsourcing firms Friedman mentions in his book. I found that administrative/marketing assistants will work from $8 to $15 per hour, while the services of a computer programmer range from $10 to $30 per hour.

When I grew up back in the former East Germany, I remember my parents always harping on me to “finish my dinner because there are starving people in India.” You may have heard that too, but recently I heard this quote being changed to parents telling their kids “finish your homework, because there is somebody in India who wants your job.”

It’s a fascinating book that describes the enormous impact of a continuously flattening world. It’s a must read for everybody because Friedman also explains the upcoming “Chinese revolution” in terms of what happens when their massive educated workforce, and soon to be English speaking, gets unleashed and involved in world markets. Among many other topics, he further elaborates what you must do to protect your job from being outsourced.

If you haven’t read it, I recommend it; it will do more for your understanding of how the world operates nowadays than the daily hyped up news barrage.

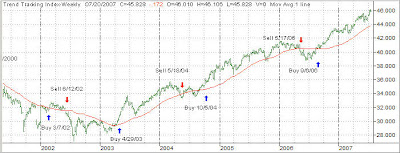

With my ETF Master List now containing 497 ETFs, the investment choices are becoming definitely overwhelming to some. Using momentum figures, as displayed in my weekly StatSheet, makes it easy to sort out those performers that are worthy your attention and discard those which are heading in the wrong direction.

With my ETF Master List now containing 497 ETFs, the investment choices are becoming definitely overwhelming to some. Using momentum figures, as displayed in my weekly StatSheet, makes it easy to sort out those performers that are worthy your attention and discard those which are heading in the wrong direction.