I have been elaborating on the need for methodical investing almost on a non-stop basis. Sometimes it seems that, when reading media stories, that I am the lone ranger. Many of my newsletter readers are aware of that and at times submit stories that support the fact that there are others who have similar viewpoints by trying to make sense out of Wall Street’s irrationalities.

I have been elaborating on the need for methodical investing almost on a non-stop basis. Sometimes it seems that, when reading media stories, that I am the lone ranger. Many of my newsletter readers are aware of that and at times submit stories that support the fact that there are others who have similar viewpoints by trying to make sense out of Wall Street’s irrationalities.

Recently, reader Mike shared an article from “Money and Markets” titled “U.S. Stocks Skating on Thin Ice.” Author Tony Sagami makes a lot of sense, and not only because it goes along with my way of thinking, when he outlines 4 things you can do to protect yourself from more stock market weakness:

1. Adjust your asset allocation. This is a great time to look at what percentage of your portfolio is invested in stocks, bonds, cash, etc. If you’re heavily invested in stocks, you may want to consider reducing your equity exposure and raising cash.

2. Implement stop losses. These orders tell your broker to sell your shares if they fall to a predetermined price. Only you can decide what prices you’d like to sell at, but many investors choose an acceptable percentage amount (say, 10%) and apply that to each of their positions.

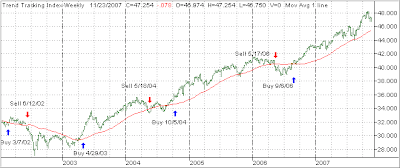

3. Use a strict sell discipline. Market technicians use tools like moving averages, relative strength indicators, and other momentum-oriented tools to tell them when to buy and sell. One of the simplest market-timing strategies is selling a stock or fund whenever it drops below its 50-day moving average. But whatever indicator(s) you use, the key is removing as much emotion as you can from the process.

4. Don’t get stuck in one country. The U.S. economy is rapidly slowing and even on the verge of falling into a recession. However, that is hardly the case in other parts of the world. It’s a lot better to invest in countries that are growing like mad than those that are crawling along like inchworms.

I agree with Tony’s assessment because as part of trend tracking we regularly follow all of those suggestions. The only caveat I have is regarding his point 4. As the U.S. markets slide, so will most countries but at an accelerated pace. But you already know that. If you followed our recommended sell stop discipline, you should not have much exposure to most foreign countries, especially those that have come off their highs by more than 10%.