Bloomberg reports that Munis have their worst month since 2003 on Auction-Rate woes. Here are some highlights:

U.S. municipal bonds are headed for their worst month in more than four years after collapsing demand for securities with rates set at periodic auctions sent debt costs for state taxpayers and hospitals as high as 20 percent.

State and local government bonds fell 4.17 percent through yesterday, including reinvested interest, based on Merrill Lynch & Co. data. That’s the most since July 2003, when they tumbled 4.59 percent. Florida had to pay 5.35 percent yesterday to sell 30-year fixed-rate general obligation bonds, almost three- quarters of a percentage point more than at its Feb. 6 sale.

The $330 billion auction-rate market froze after dealers stopped purchasing the bonds when buyers failed to bid. Their lack of support has spread to the broader tax-exempt market, sending yields soaring. Borrowers from California to New York City plan to convert the securities to longer-term debt, raising concern that a flood of bonds will overwhelm already sparse demand from banks and hedge funds.

…

The auction-rate turmoil and slump in municipal bonds are the latest examples of how the fallout from subprime-mortgage delinquencies has spread, touching a market whose credit quality is typically second only to the U.S. government.

…

Failures [at auctions] have increased as subprime-related losses at bond insurers led investors to question their creditworthiness and to shun securities carrying their backing, and banks refused to step in and buy unwanted bonds as they had in the past.

Dealers including Goldman Sachs Group Inc., Citigroup Inc., UBS AG and Merrill Lynch & Co. stopped using their own capital to support the sales, allowing some yields to rise to 20 percent. Investors and borrowers never knew the extent that banks propped up auctions because of scant public disclosure of bidding.

…

While households hold most of $2.6 trillion in U.S. municipal securities, either directly or through funds, rising demand from banks, hedge funds and other institutional investors dominated the market in recent years.

By borrowing at variable rates to buy higher-yielding long- term debt, they helped absorb the record $430 billion sold in 2007 and drove state and local debt to outperform Treasuries and corporates three straight years through 2006. Since then, municipal bonds gained 1.3 percent and their taxable counterparts rose 9 percent, Merrill data shows.

The unwinding or attempts to unwind such trades by hedge funds may be exacerbating the declines, investors said.

“The municipal market in the last week and a half or so has been in a free fall,” Warren Pierson, vice president and municipal portfolio manager at Robert W. Baird & Co., said in an interview from Milwaukee.

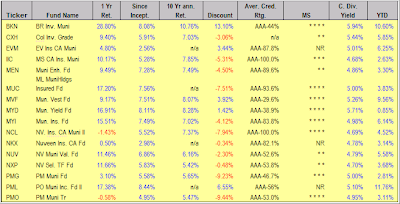

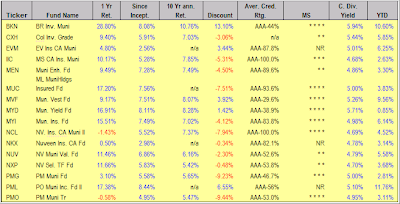

To demonstrate the severe change of closed end muni funds over the past few weeks, you only need to look at my StatSheet (section 7), which features a variety of muni funds. Take a look at the chart, which I posted the end of January containing data effective January 30, 2008.

Note the column on the far right, which shows YTD returns, without distributions (click on chart to enlarge):

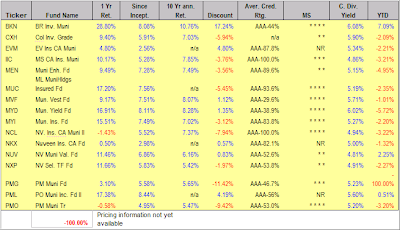

Now fast forward a few weeks to February 27, 2008 and look at the same YTD column:

The difference is simply astounding with some funds having lost around 8% in only a few weeks. Keep in mind that muni funds have historically been very safe (less than 1% failure rate) and more stable than most equity investments.

The current credit turmoil seems to be spreading everywhere, even where it’s least expected.

As I posted before, this is not the time for your to be a hero and take undue risk, because you simply can’t evaluate today’s risk with standards that no longer apply.

Until the dust clears and major trends become identifiable, keep your money safely in U.S. Treasuries and, if you’re more aggressive, invest in selected sectors that have successfully bucked the domestic markets.

Yes, I have said that before, and I will do so again. Why? Because based on some of the e-mails I have received, I have to say that most investors are not yet in tune with market reality.