A couple of days ago, I posted about the obvious as to who eventfully will have to foot the bill if the Fed’s guarantee of JP Morgan’s purchase of Bear Stearns’ assets should prove to be a losing proposition.

A couple of days ago, I posted about the obvious as to who eventfully will have to foot the bill if the Fed’s guarantee of JP Morgan’s purchase of Bear Stearns’ assets should prove to be a losing proposition.

MarketWatch featured a follow up story about the Fed’s partnership with JP Morgan. Here are some highlights:

The Federal Reserve has gone into business with J.P. Morgan Chase & Co. by taking effective ownership of $30 billion of the most toxic waste on Bear Stearns’ books.

In the latest groundbreaking move from the central bank, the New York Federal Reserve Bank will manage and dispose of the high-risk securities that helped push Bear Stearns Cos. over the brink and into the arms of J.P. Morgan.

If the securities, valued at $30 billion on March 14, sell for more than $30 billion, the Fed will take the profit. If they sell for less, J.P. Morgan will assume the first $1 billion in losses, with the Fed on the hook for the remaining $29 billion.

The details announced Monday are slightly more favorable to the Fed than the arrangement announced a week earlier, but, for many critics, the changes don’t amount to much more than putting lipstick on a pig.

…

J.P. Morgan will set up a limited liability company to hold the Bear Stearns assets, which will “ease administration of the portfolio and will remove constraints” on Blackrock Financial Management Inc., which has been hired to manage the portfolio “under guidelines established by the New York Fed to minimize disruption to financial markets and maximize recovery value.”

Blackrock will work for the New York Fed, not for J.P. Morgan.

J.P. Morgan will finance $1 billion on the debts. Financing on the other $29 billion will be extended by the Fed to J.P. Morgan at the discount rate, which is currently 2.5%.

Repayment of the Fed’s loan should begin in two years, the Fed said.

For many analysts, the fundamentals of the transaction remain unchanged: gains on Wall Street are privatized while losses are socialized.

The last sentence pretty much sums it up. If there are losses, the taxpayer will take the hit, if there are gains, the government will keep them.

Looking at the big picture, however, I feel like I’m stuck in this dichotomy: On one side, in a capitalistic society, a failing enterprise should be allowed to fail and the market place will sort things out without any government intervention or involvement.

On the other side, you could make the argument that if a failing enterprise, such as Bear Stearns, with its non-transparent assets and financial intertwinement with many banks and other institutions, poses a potential risk of causing the financial system to collapse, then intervention might be warranted.

The speed, with which the Fed stepped in to lend a helping hand, makes me believe that we were close to a financial collapse with a potentially incalculable domino effect, which was avoided for the time being.

The question in my mind remains as to whether an intervention is justified given the circumstances as described. What’s your view?

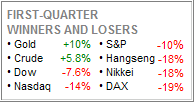

As it turned out, this past quarter was one that many investors, traders and advisors are glad to put behind them. The major markets, as the above table shows, were mired deep in red and many sector trends came to an end in January causing several whipsaws. It was the steepest decline in 5 years.

As it turned out, this past quarter was one that many investors, traders and advisors are glad to put behind them. The major markets, as the above table shows, were mired deep in red and many sector trends came to an end in January causing several whipsaws. It was the steepest decline in 5 years.