Market Watch reports that the Bank of England is to unveil a mortgage bailout:

Market Watch reports that the Bank of England is to unveil a mortgage bailout:

Faced with rising mortgage rates that threaten to worsen a housing downturn, the Bank of England will unveil a plan Monday to allow banks to swap billions of pounds worth of mortgage-backed securities for British government bonds in a bid to thaw frozen credit markets, Chancellor of the Exchequer Alistair Darling said Sunday.

“The Bank of England will be making an announcement” on Monday, Darling said in a BBC television interview. “What it will do is effectively lend banks money to unfreeze the situation we have got at the moment.”

Shares of Britain’s biggest lenders rose late last week in anticipation of the plan. Darling also said he expects more banks to unveil details of subprime-related losses, the size of their mortgage-backed securities holdings and plans to raise capital.

U.K. mortgage rates have risen and lenders have increasingly tightened lending conditions and have pulled some mortgage products off the market as banks have become increasingly reluctant to lend money to each other.

Banks have hoarded cash as they’ve sought to rebuild their own balance sheets in the wake of the subprime mortgage meltdown, analysts say. Also, uncertainty over the condition of rival banks saddled with mortgage-related securities has made banks reluctant to make loans to each other.

The plan to be unveiled by the central bank is expected to see the Bank of England offer to swap as much as 50 billion pounds worth of government bonds, or gilts, for certain types of mortgage-backed securities for a period of up to a year or more, according to analysts and news reports. Banks would then be able to use the government bonds as collateral for loans from other banks.

Darling said the plan would help open up the U.K. mortgage market.

“We are doing our bit and I would like to see the banks pass on the benefit of the three interest rate cuts” by the Bank of England since December, Darling said.

Rising mortgage rates threaten to exacerbate a downturn in the British housing market, which could also accelerate a slump in consumer spending and worsen an expected economic slowdown, economists say.

Darling denied that the plan, which bears similarities to the expanded lending facility announced by the U.S. Federal Reserve last month, is a bailout. Banks will borrow the gilts, pledging the mortgage-backed securities as collateral.

[Emphasis added]

If it walks like a duck and squawks like a duck, it most likely is a duck. Just as the Fed’s willingness to accept sub par securities in exchange for U.S. Treasuries, the Bank of England has chosen to go the same route.

The plan is expected to see banks forced to take a “haircut” on the value of the mortgage-backed securities in a bid to protect taxpayers should a bank be unable to repay and the Bank of England is stuck with the mortgage-backed security. Strictly as an example, banks could be allowed to post 100 pounds worth of securities in return for 80 pounds worth of bonds, economists said.

OK, so they try to build in a safety cushion, although that is not a sure thing yet. So far no one has been able to accurately determine fair market value for any of these pledged securities here in the U.S. or in England. At least, there is no public knowledge of it.

Here’s the rub. If the values are less at sometime in the future, the loss will be socialized, if there is a gain, it will be privatized by the Bank of England. That smells like a sugar coated bailout to me.

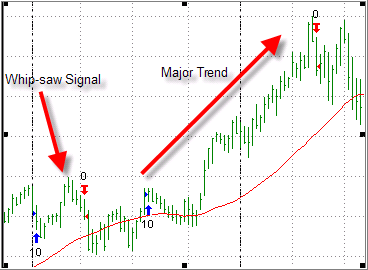

The markets zigzagged yesterday, but ended up closing modestly higher thanks to support from industry heavyweights Boeing and Microsoft. Despite this higher close, participation was not widespread, which explains why our Trend Tracking Indexes (TTIs) retreated slightly.

The markets zigzagged yesterday, but ended up closing modestly higher thanks to support from industry heavyweights Boeing and Microsoft. Despite this higher close, participation was not widespread, which explains why our Trend Tracking Indexes (TTIs) retreated slightly.