The Motley Fool featured a piece called “Smash the Market,” which focused on 4 points a savvy investor should consider before buying any mutual fund.

The Motley Fool featured a piece called “Smash the Market,” which focused on 4 points a savvy investor should consider before buying any mutual fund.

While some are questionable to my way of thinking, they are widely held beliefs and it may help you if we take a look at them one by one:

1. Fees

The myth is to focus on searching for funds with below average expense ratios and avoid load funds like the plague. ‘Amen’ to the latter and ‘not necessarily’ to the former.

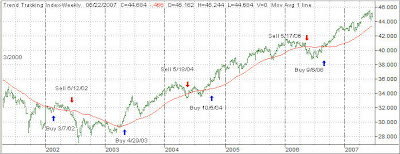

Of course, if your mode of operating your portfolio is to Buy-and-Hope through thick and thin, then the underlying cost of a fund can make an important difference.

However, if you use Trend Tracking as your investment discipline, then costs are secondary to performance because you will be exposed to the market for a shorter time frame. For example, during the rebound of 2003, after the devastating bear market, one of our holdings was NAMCX. It absolutely took of gaining some 60% over a 2-3 months period. Do you think I was concerned whether this fund actually had a peer with a lower expense ratio? Heck no; great performance for a given period can always command higher fees.

2. Tax Efficiency.

OK, while important, the article states to avoid a fund with high turnover with use of a non-tax-sheltered account. Then it goes on to say “to look for a manger with a buy-and-hold strategy.” That’s were it gets very iffy. I have actually met investors who, for tax reasons only, held on to an investment, which then proceeded to tank and lost more money then the taxes saved. That is simply insane yet many people operate that way.

3. Management

I agree somewhat with using a fund manager with some experience, although it won’t make any difference if a bear market strikes. If the objective of a fund is, say, ‘domestic large blend,’ then that’s what he has to invest in. If the trend heads south, guess what? The experienced manager will lose your money just as well as the inexperienced one.

4. Strategy

This one gets to me as article says that “the fund’s manager should have a proven strategy that’s been battle tested over numerous market cycles.”

Huh?

If he runs a fund that’s supposed to be long in the market, how can he have a proven strategy? How will he deal with a bear market? While he can make some adjustments to his portfolio, he can never ever be 100% in cash? Why? So the investing public can always buy and redeem shares.

Be aware that as an investor, you will have to come up with a strategy that keeps your portfolio intact when the markets slide. Don’t rely on your mutual fund—you will live to regret it.