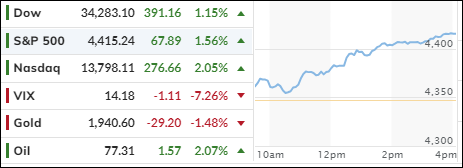

- Moving the markets

The market had a good start today, thanks to some chill inflation numbers. But then it ran out of gas. Literally. Gas prices dropped like a rock, dragging down the producer price index (PPI) by half a percent. That’s the biggest fall since the pandemic started. But if you take out food and energy, the PPI didn’t budge. And it’s still higher than it was last year.

Not everything was rosy, though. Retail sales also dipped a bit. But hey, at least they didn’t dip as much as the experts predicted. That’s something, right?

Meanwhile, the interest rate on the 10-year Treasury bond bounced back after a big drop yesterday. That’s because the market cares more about retail sales than PPI. And apparently, retail sales were hot enough to push up the rates.

But don’t get too excited. Inflation is still a problem. And the Fed is still asleep at the wheel. Just listen to what analyst Peter Schiff had to say:

Prices are going to keep on rising because the budget deficits are skyrocketing. The money printing is going to continue. The inflation burden is going to be heavier, and heavier, and heavier. And this consumer, who has already been shot up, is going to get shot some more.

The reality is the Fed hasn’t done enough to stop price inflation. They haven’t tightened enough to stop the borrowing. But they have tightened enough to break an economy that is rooted in artificially low interest rates.

Will this reality eventually break through?

In other news, the financial situation is still loosey-goosey, the short squeeze is over, bond yields are up, the dollar is flat, and gold is down. Oil prices also took a dive, ending up where they started on Monday.

And in case you were wondering, the government might shut down soon. The House passed a bill to keep it open, but the Senate still must vote on it. And you know how they are.

Would that be a bad thing?

Read More