Hat tip to Mish at Global Economics for pointing to this story at Bloomberg titled “Q Ratio Signals Horrific Market Bottom:”

Hat tip to Mish at Global Economics for pointing to this story at Bloomberg titled “Q Ratio Signals Horrific Market Bottom:”

A global stock slump may have further to go, according to Tobin’s Q ratio, which compares the market value of companies to the cost of their constituent parts, CLSA Ltd. strategist Russell Napier said.

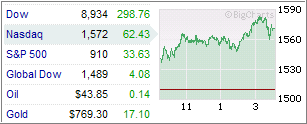

The ratio, developed in 1969 by Nobel Prize-winning economist James Tobin, shows the Standard & Poor’s 500 Index is still too expensive relative to the cost of replacing assets, said Napier. While the 39 percent drop in the index this year pushed equity prices below replacement cost, history suggests the ratio must sink further as deflation sets in, he said. The S&P; may plunge another 55 percent to 400 by 2014, Napier said.

“The Q has come down to its average, however it’s not always stopped at the average,” said Napier, Institutional Investor’s top-ranked Asia strategist from 1997-1999. “It has tended to go significantly below that in long bear markets.”

Shares have fallen this year as the worst financial crisis since the Great Depression caused almost $1 trillion of bank losses and dragged the world’s largest economies into recessions. The MSCI World Index has tumbled 44 percent in 2008, set for the biggest annual decline in its four-decade history.

…

Napier, who teaches at Edinburgh Business School and advised clients to buy oil in 2002 before it tripled, based his S&P; 500 forecast on the Q ratio for U.S. equities as well as the 10-year cyclically adjusted price-to-earnings ratio, another measure of long-term value.

Before the trough in 2014, investors are likely to see a so- called bear market rally for the next two years as central bank actions delay the onset of deflation, Napier said.

“In the long run, stocks will become even cheaper,” said Brian Shepardson, who helps manage $1.9 billion at Xenia, Ohio- based James Investment Research. The firm’s James Balanced Golden Rainbow Fund beat 98 percent of similar funds this year. “There’s a likelihood of some type of rally and further pullback surpassing the lows we’ve already set.”

The Q ratio on U.S. equities has dropped to 0.7 from a peak of 2.9 in 1999, and reaching 0.3 has always signaled the end of a bear market, said Napier, 44, the author of “Anatomy of the Bear,” a study of how business cycles change course. The Q ratio for U.S. equities has fluctuated between 0.3 and 3 in the past 130 years.

When the gauge is more than one, it indicates the market is overvaluing company assets, while a Q ratio of less than one signifies shares are undervalued because it is cheaper to buy companies than to build them from the ground up.

At the end of the four largest U.S. bear markets in 1921, 1932, 1949 and 1982, the Q ratio fell to 0.3 or lower, and history is likely to repeat, said Napier. From the 1982 trough, the S&P; 500 grew more than 14-fold to the middle of 2000, when Napier says the last bull market ended.

…

Napier’s prediction for a plunge in the S&P; 500 hinges on deflation that is unlikely to materialize, according to Bob Brusca, president of Fact & Opinion Economics and a former chief of international markets at the New York Federal Reserve. Consumer prices dropped 1 percent in October. So-called core prices, which exclude food and energy, dropped just 0.1 percent, and prices will probably increase 0.7 percent in 2009, according to the median estimate of economists surveyed by Bloomberg.

“Oil and commodity prices have fallen, but we’re not seeing a widespread deflation like he’s talking about,” Brusca said in an interview in New York. “To have what he discusses, we’d have to have terrible deflation.”

…

“For those who are worried about losing much of their investment almost overnight, very clearly you’d want to wait for those signals to give a much stronger case,” he said. “The bear market will have “a painful resolution, it’s just a question of how painful, over what period of time and for what parties.”

Federal Reserve Chairman Ben S. Bernanke’s indication that he will use “quantitative easing” to prevent deflation points to a stock market rally that may last for the next two years, Napier said. With quantitative easing, a tool pioneered by the Bank of Japan, central banks can stimulate inflation by printing money and flooding the market with cash in order to encourage consumers to spend.

The government’s efforts will eventually fail as ballooning government debt devalues the dollar, causes investors to flee U.S. assets and takes the S&P; 500 to its eventual bottom in 2014, Napier said.

“Bear markets always end for exactly the same reason, and that is the market begins to price in deflation,” he said. “The results are always horrific.”

Whiles this is just one man’s forecast, the last three paragraphs sum up nicely what a lot of readers have been asking lately, which is what the long-term effects of the various stimulation packages might be. While the long-term effects will be inflationary, short to intermediate-term we are tied up in a deflationary scenario, which will have to play itself out before the tide turns.

If in fact a 2-year rally materializes, our Trend Tracking Indexes will get us back into domestic equities at a time when the trend has clearly broken out to the upside. Conversely, using our exit strategy, we’ll be able to get out before the bear again starts to take charge.