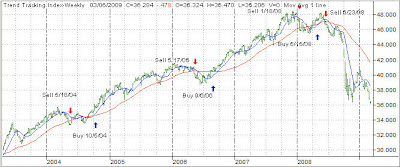

Despite last year’s (and this year’s) market collapse there are still plenty of writers, brokers and others who simply don’t get it. They have stuck to their proven method of losing a large amount of their portfolio value in record time due to, well, sheer ignorance.

Reader GH had this to say on the subject:

You simply must visit this page and ponder the nonsense.

Here’s an example: “…if you’ve not already proven that you can time the market effectively and consistently beat these passive strategies, then you have no excuse but to implement them until you do.”

Farrell and his followers never give up.

I have always chuckled about the “lazy portfolios” over the years, since they too ignore the fact that bullish portfolios will get killed in a bear market—no exceptions. MarketWatch continues to waste readers’ time by featuring the returns of those portfolios as shown in the following table:

If you are a buy and hold investor, you have now earned the right, if you had invested in these portfolios, to pound your chest and proudly declare having outperformed the S&P; 500.

Such perverse opinions are passed down from Wall Street. Some genius in the past figured out that, as a fund or money manager, all you have to do is outperform the S&P; 500, and you are a winner. The fact that you still lost some 33% is really immaterial; your investors are sure to forgive you.

Until the public finally wakes up to the fact that they are getting shafted over and over and start voting with their feet by leaving, it’ll be business as usual.

In a sense, we are our own worst enemy since deep down we’re always eager to accept something for nothing. Lazy portfolios promote that theme and, until people are willing to step up to the plate by taking responsibility, considering pros and cons of various investment approaches, they will always be left holding the empty investment bag when the bear rears its ugly head.

As almost has become a habit at the beginning of a new week, the market took another hit to the downside yesterday.

As almost has become a habit at the beginning of a new week, the market took another hit to the downside yesterday.