I don’t quote Barron’s very often, but they featured a nice piece on risk titled “That’s Better Now.” Let’s look at some highlights:

I don’t quote Barron’s very often, but they featured a nice piece on risk titled “That’s Better Now.” Let’s look at some highlights:

Investment success last year meant embracing risk. Certainly, it wasn’t hard to find.

Following 2009’s sharp rally, investors had to confront their fears about weak U.S. housing and employment, Europe’s ugly sovereign balance sheets, May’s violent flash crash, a sharp swing in U.S. political sentiment, deficit-ridden state and local governments, and the effects of easy U.S. monetary policy in order to partake in a second-half stock-market surge that many reasonable people mistrusted. Risk was rewarded.

In such an unpredictable year, the mutual-fund families that delivered the best overall returns for their shareholders didn’t take money off the table, flee to defensive stocks or hide in Treasury bonds. That made for some unusual winners in our annual ranking of the best fund families. A prime example is the leader of the Barron’s/Lipper ranking: Dimensional Fund Advisors, a quantitative-fund group with many index-like qualities. DFA was followed by Nuveen Fund Advisors, newcomer Principal Management, Oppenheimer Funds, and Waddell & Reed Investment Management.

Overall, they topped their rivals with strong returns in areas like emerging-market stocks, which were up 19.54%, small- and mid-cap growth and value plays, which gained 27.74% and 24.19%, respectively, and global high-yield funds, which rose about 3.50%, according to Lipper.

…

CAN MUTUAL-FUND FAMILIES and their investors continue to dodge the raindrops for another year? Not only are stocks at higher levels and bond yields still low, none of 2010’s risks have disappeared and a new one — political upheaval across the Mideast and North Africa — has appeared. The unrest in Egypt and elsewhere is a challenge for big oil companies that depend on the region for much of their supply, says Henry Herrmann, CEO of Waddell & Reed. And the worries about U.S. states and municipalities have worsened of late, driving $13.37 billion out of municipal-bond funds in December, a trend Degroot warns could continue.

“This could be the trend in the year ahead — risk on, risk off — with people thinking ‘the world is coming to an end’ or ‘maybe I’m missing the trend,’ ” observes Degroot.

Possibly a little late, retail investors seem to be getting their courage up to wade into U.S. stocks again. From Jan. 1 to Jan. 26 of the New Year, $11.82 billion flowed into U.S. large-cap growth and value equity funds, more than triple the $2.82 billion that went into international stock funds, according to Lipper. In 2010, $74.88 billion flowed out of U.S. stock funds, while $42.71 billion came into international stock funds, and a gargantuan $213.25 billion poured into taxable-bond funds.

Not everyone agrees that risk levels are rising: “The risky stuff is more stable this year,” says Art Steinmetz, chief investment officer of Oppenheimer.

…

“Appetite for risk will work until it doesn’t,” adds Jeff Tjornehoj, senior research analyst at Lipper in Denver. “The time to take risk is when people are absolutely scared out of their minds.” That time may have passed.

[Emphasis added]

There is much more to this article so check out the link if this interests you. I think the last paragraph above sums it up nicely. Risk has clearly increased with the major indexes hovering at these multi-year high levels.

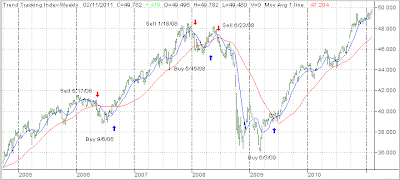

I have repeatedly said that no portfolio growth has really been accomplished since June 2008, because the past 2-1/2 years have been spent making up losses—nothing else.

Of course, we could march even higher from here although the markets are priced to perfection as are expectations of future economic developments. Add to that the usual menu of potential global uncertainties, and I have to question whether this rally will end well.

For a better and well researched historical perspective, Mish at Global Trends wrote a fine article on the subject, which you can

read here. It’s a bit lengthy but well worth your time.