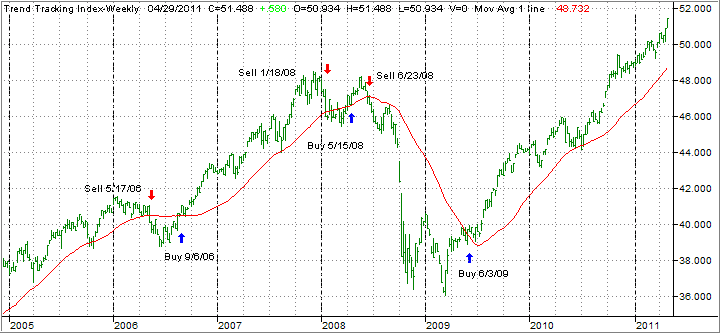

For a couple of years now, I have been charting the Ivy ETF Portfolio to see how well it would work within the rules of trend tracking.

For a couple of years now, I have been charting the Ivy ETF Portfolio to see how well it would work within the rules of trend tracking.

If you are not familiar with “The Ivy Portfolio,” you can buy the book at Amazon. It shows step-by-step how to track and mimic the investment strategies of the highly successful Harvard and Yale endowments.

Using the endowment policy portfolios as a guide, the authors illustrate how an investor can develop a strategic asset allocation using an ETF-based investment approach.

More importantly, the book reveals a novel method for investors to reduce their risk through a tactical asset allocation to protect them from bear markets. Translated that simply means they are using a trend tracking approach to only remain invested during bull markets, while moving to the sidelines during bear markets.

It is trend tracking at its finest, but there are two major differences to the approach I have been advocating for over 20 years: