ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/06/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-6162011/

————————————————————

Market Commentary

Friday, June 17, 2011

ETFs IN RETREAT: STAGGERING NORTH, SOUTH AND NOWHERE

Tuesday’s relief rally (or was it a dead cat bounce?) is now a distant memory, only visible in the rear view mirror, as Wednesday’s return to reality took back all of the previous day’s gains and then some.

There was nothing new, as the same old worries about global growth, domestic inflation and the now out of control spinning Greek debt crisis took their toll and sent the major market ETFs to the mat. The remainder of the week was spent in aimless meandering depending on the news reports du jour.

In the end, the Dow and the S&P 500 managed to eke out tiny gains for the week, while the Nasdaq lost. In case you missed it, and you are one looking for extreme high returns, the Greek 2-year bond is now sporting a mind boggling 30% yield. Does that sound like an investment that will be around in 2 years? I think not.

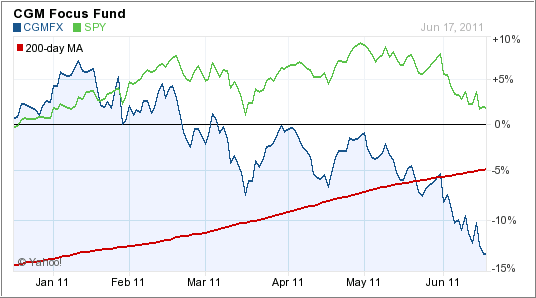

Our Trend Tracking Indexes (TTIs) slipped with the markets and, as I posted on Wednesday, the International TTI has now entered officially bear market territory, since it had dropped considerably from last Friday’s close.

Here’s where both indicators stand in relation to their long-term trend lines after the close today:

Domestic TTTI: +1.87% (last week +2.16%)

International TTI: -1.69% (last week -0.70%)

European politicians are now in a feeding frenzy desperately trying to overcome their differences and maintain face while attempting to convince the world that Greece deserves more rescue funds no matter what.

I am certain that this debt debacle will continue to be front page news next week as will be the FOMC rate decision along with a few economic reports like home sales, initial claims, GDP and durable orders.

Be sure to track your trailing sell stops on all holdings, if you do your own investing. Earlier this week, I liquidated our positions in the energy sector (VDE) and today, I sold the emerging markets (VWO). Interestingly, while VWO was still positioned slightly above its sell stop point, it had pierced its respective long-term trend line to the downside making that move a priority.

Volatile times in the market are certain to stay with us a while longer, so prepare your next move ahead of time. That way, you don’t sweat it when the market heat is on.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Myth:

Q: Ulli: I want to try one of your model portfolios for my 401(k). I’m thinking of selling my current holdings in my 401k and buy those funds in one of those portfolios. Is that a good idea? I don’t manage my 401k well so I want to try yours. I have a brokerage account in my 401k which would allow me to do that.

A: Myth: Yes, you can do that, but not right now. We are on the verge of slipping into bear market territory, and you should be watching your sell stops and not adding new positions or switching to a different portfolio.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/