With the markets having staged a rebound over the past few trading days, it’s no surprise that this strength positively affected some of the High Volume Major Market ETFs, however, on balance, when looking at the big picture, it was a mixed bag.

To clarify, High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

Let’s look not only at the winners, but also at those ETFs, whose positions worsened despite the positive market environment.

Improving their positions within the first 20 spots above the Cutline were:

XLY (Consumer Discretionary) from +7 to +19

VTI (Total Market Index) from +5 to +15

IWB (Russell 1000) from +6 to +14

SPY (S&P 500 Index) from +4 to +9

Just because these Major Market ETFs have moved up further into plus territory does not make them a buy, since most of their respective momentum numbers are still negative.

Slipping further below the trend line, or holding fairly steady at lower levels, despite an elevated market, were the following ETFs:

IEV (S&P Europe 350) from +1 to -5

RSX (Russia) from +11 to -6

IOO (S&P Global 100) from -3 to -9

VWO (Emerging Markets) from -14 to -11

BRF (Brazil Small Cap) from -16 to -15

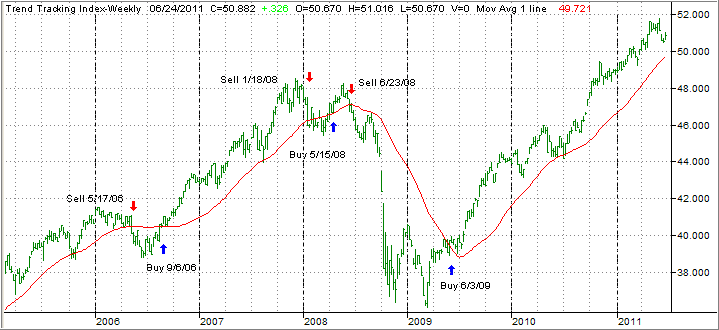

First, take a look at the table and then read my latest commentary:

Read More