ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/07/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-772011/

————————————————————

Market Commentary

Friday, July 8, 2011

Lousy Jobs Data Stops Bulls In Their Tracks – Major Market ETFs Pull Back

Much anticipation had been built on the release of today’s jobs report. Even preliminary figures from ADP on Thursday raised hopes that there would be reason to cheer.

Then came reality, and the only cheering came from the bearish crowd, as the unemployment report turned out not to be only below expectations, it was downright horrible—a complete miss.

Unemployment rose to 9.2%, there was very little job growth (18,000 added), wages were not rising and hours worked remained flat. For sure, this will force many forecasters to reduce their projections for the second half. In other words, two years after the alleged recovery began, labor conditions have not improved at all.

The only surprise to me was that this day did not turn into a disaster. Yes, the markets pulled back but not as much as this report would have warranted. Why? Wall Street traders are an optimistic bunch, so they simply looked past this report and focused on the upcoming earnings season. Maybe there’s something to cheer about after all. Go figure…

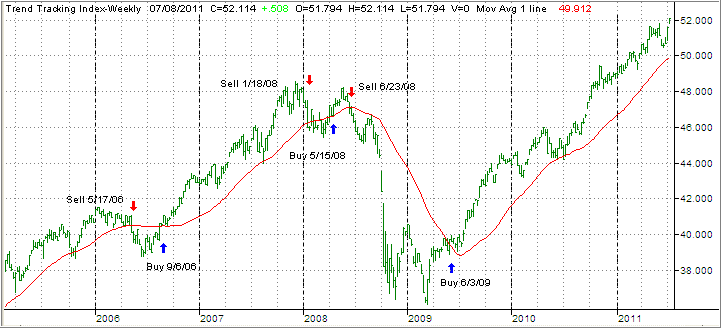

Our Trend Tracking Indexes (TTIs) provided a mixed picture, compared to last week, as the domestic one gained strength while the international one lost momentum. Here are today’s prices:

Domestic TTI: +4.54% (last week +3.67%)

International TTI: +1.26% (last week +1.72%)

This weakening on the international side has kept me from issuing a new ‘Buy’ for that arena despite the crossing of the trend line to the upside. To avoid an immediate whipsaw signal, I’d rather wait for more confirmation that upward momentum has indeed been restored before pulling the trigger.

Next week, we’ll be facing a host of economic reports along with the start of earnings season. Let’s hope there are some positives, otherwise, the only ones doing the cheering will be the bears.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Stefanie:

Q: Ulli: I am just starting to look at your portfolios and buy/sell parameters, but I would appreciate a definition of “sell” criteria like the “buy” explanation you gave recently.

A: Stefanie: The “Sell” is automatically determined by your trailing sell stops getting triggered. As such, they serve 2 purposes:

1. To limit your downside risk, if the markets head south right away, or

2. If a rally continues, they will lock in your profits when the inevitable turnaround occurs.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/