ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, July 15, 2011

AGAINST THE WIND

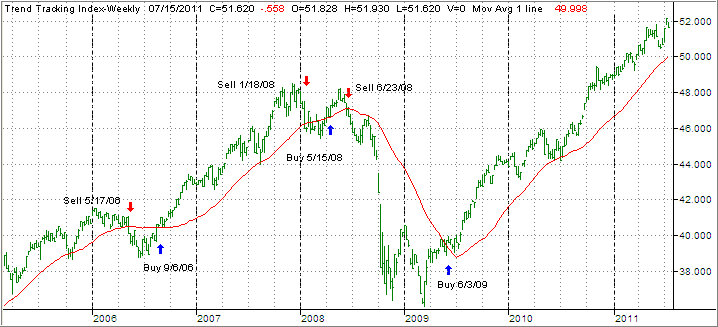

The major market ETFs simply faced too many headwinds and, as a result, the S&P 500 lost 2.1% for the week after two weeks of gains.

No matter where you looked, the news was predominantly negative as Europe’s worsening debt crisis set a sour mood last Monday and Tuesday. On Wednesday, confusion reigned as Fed chief Bernanke, the big flip flopper, left the markets guessing as to future stimulus.

The Disciplined Investor put it best:

After Bernanke’s latest testimony, we may want to consider him the latest King of Spin for this economy. Bernanke has successfully been able to destroy the US Dollar all while keeping a “Strong Dollar Policy”. He has also flip flopped so much on key subjects such as monetary policy that we are not so sure what he has planned next. He has kept Wall Street on their toes that is for sure. Let’s look at his latest testimony to see what we are talking about: