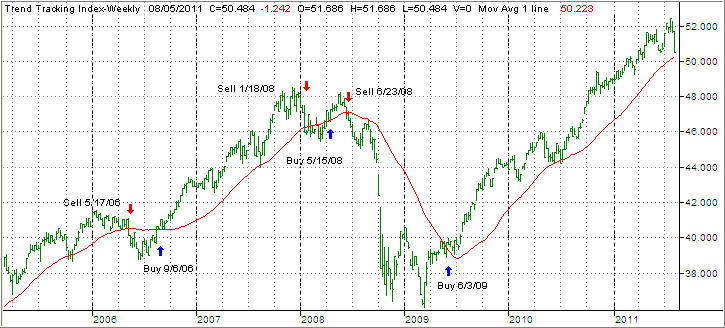

The drubbing of the markets since the last High Volume ETF Cutline report, with the S&P 500 losing some 3.5%, did not help the ETFs positioned above the cutline, as many lost momentum and succumbed to bearish forces.

The expanded High Volume ETF Cutline report includes all ETFs above and below the cutline (trend line). To clarify, High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of some 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

As a result of last week’s spanking, we now have only 25 ETFs positioned above the cutline, and in bullish territory (down from 54), and 65 below and in bearish territory (up from 34).

Yesterday’s market reversal saved the day thanks not to great economic news but merely to rumors that top Fed officials were considering support for more monetary easing. Sure, strength in the Nasdaq helped, but after relentless selling for 8 days, the markets have become somewhat oversold and a bounce, for whatever reason, was a natural reaction.

All eyes are on Friday’s jobs report, which will be scrutinized for any positives, if they can be found. Absent of those, it is pretty clear that the economy has stalled, and the markets have simply reacted accordingly.

Here’s the current HV ETF Cutline table:

Read More