ETF/No Load Fund Tracker For Friday, August 5, 2011

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/08/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-842011/

————————————————————

Market Commentary

Friday, August 5, 2011

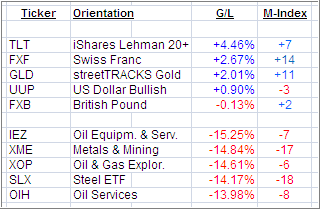

SELL-OFF TSUNAMI

Volatility continued today as the Dow see-sawed from a plus 171 points to a minus 245 points, but ended up settling at +61.

The other major market ETFs followed a similar pattern and, after it was all said and done, the most widely tracked barometer, the S&P 500, had lost -7.2% for the week and is now down -4.6% YTD. For comparison, our core holding, PRPFX, gave back a more modest -2.48% but is up +5.61% YTD.

There was virtually no place to hide as the Dow had its worst week since March 2009, and many investors are certainly glad that these past 5 trading days are over.

The jobs report was better than feared, which helped the markets in the early going. However, it was certainly not a stunner, quite the contrary, and not strong enough to overcome general uneasiness about the state of the economy and the European crisis.

Our Trend Tracking Indexes (TTIs) moved lower and remain in the following positions relative to their respective long-term trend lines:

Domestic TTI: -0.06% (last week +3.04%)

International TTI: -8.20% (last week -1.17%)

As you can see, the international TTI has really accelerated into bear market territory since last Friday, while its domestic cousin just slightly dipped into it by a meager -0.06% after the close today. This drop below the line is not enough to declare the current bull market in domestic equities from being over. I like to see a clear piercing to the downside before declaring this bull dead.

Next week, more economic data are on the menu, which might give some guidance as to the worsening or improving of the current economic status. I will watch the domestic TTI closely and will post any important developments to the blog.

I sure hope that you heeded my constant reminders to execute your trailing sell stops when they get triggered. These are the times you need to be disciplined, especially when world markets are panicking. Hence my constant reminder for you to always prepare your exit strategy ahead of time, during calmness in the market, so you don’t stress when the heat is on.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Dick:

Q: Ulli: Thanks for posting your ETF approach to PRPFX. Have you ever considered the following?

PRPFX is a modified version of Harry Browne’s “Permanent Portfolio.”

People who follow Harry’s approach hang out at:

http://www.gyroscopicinvesting.com/forum/index.php

They advocate 4 ETF’s, 25% each:

IAU, VTI, TLT, SHY or a Treasury $ MKT account

Rather than a stop loss, they use a rebalancing approach based on a band (usually + or – 10%, to take from one that’s grown and add to rebalance with one that’s down.)

If you have thought of Harry’s original approach, I would appreciate any comments you might have.

A: Dick: Yes, I read Harry’s book some time ago and agree with the composition he proposes. I don’t agree that PRPFX can always be held. Sometimes you just have to get out of it, or hedge it; a good example would have been 2008. I will talk about the hedging part in a post this coming Sunday.

I have tried the 4 ETF combinations, and they have not worked very well, which is why I came up with my own version. Sometimes the copy is better than the original, at least for this moment in time.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/