ETF/No Load Fund Tracker Newsletter For Friday, August 12, 2011

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/08/weekly-statsheet-for-the-etfno-load-fund-tracker-newsletter-updated-through-8112011/

————————————————————

Market Commentary

Friday, August 12, 2011

BULLS MANAGE DAMAGE CONTROL

In a way, the bulls lucked out this week, as the rebounds of the past couple of days wiped out some sharp losses, which resulted in the benchmark S&P 500 ‘only’ giving back 1.7%.

Retail sales figures suggested that consumers are still spending, which proved to be the catalyst for today’s continuation to the upside. That was somewhat surprising and contradictory as the consumer sentiment index fell to its lowest level since 1980 indicating that consumer are not very optimistic. No surprise there, as more opinions abound that another recession is probable.

Despite the two up days, many challenges remain. Suspiciously absent from the news menu were more negative reports from the European debt crisis, which could shift into the next higher gear at anytime and roil world markets.

Our Trend Tracking Indexes (TTIs) diverged and are showing the following positions relative to their long-term trend lines:

Domestic TTI: +0.82% (last week -0.06%)

International TTI: -9.27% (last week -8.20%)

As you can see, the international TTI has sunk further into bear market territory, while its domestic cousin has again started nibbling on the plus side. However, the widely followed Golden Cross/Death Cross just turned negative by -0.19%. If you are not familiar with this combo, you can read about it here.

As I posted before, I will not issue a new Buy signal for that arena until the trend line has not only been clearly pierced to the upside, but has also shown me some staying power. The reason is to avoid a potential whipsaw signal.

The S&P 500 remains stuck below its widely followed 200-day M/A by -8.31% indicating that a lot more momentum to the upside is needed before this rebound can be considered a return to the bullish territory.

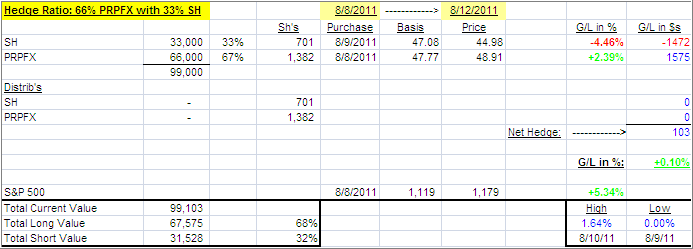

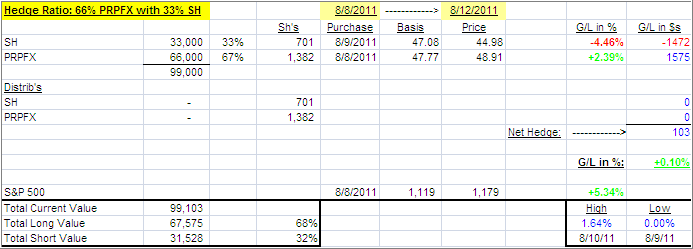

Strong headwinds remain, and it is a wide open guess as to whether volatility will slow down in the near future. Our PRPFX hedge is still on the positive side and the current status is as follows:

I will hold on to this hedged position for the time being.

Next week, we’ll be looking at a bunch of housing reports along with Industrial Production, PPI, CPI, Initial Claims and Leading Indicators.

Being on the conservative side with your investments, either out of the market or hedged, is a wise course of action, unless you have a reckless killer gambling instinct, which you needed to comfortably make it through a week like the past one.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Don:

Q: Ulli: Do you think it would be o.k. to get into the market now with a purchase of PRPFX and the 50% hedge with SH the following day when the fund settles? I would think since the position is hedged, it wouldn’t make too much difference when the positions are established.

Right of wrong?

Thanks for your valuable input.

A: Don: Say, you have an order in to buy PRPFX today, then, ideally, you want to buy SH at the close today to have the proper ratio to start with. It’s usually not exactly possible, but you can come close if you buy within 10 minutes of the close.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/