Domestic equity markets erased early losses and closed the trading session solidly higher after the Federal Open Market Committee failed to announce plans to reduce the pace of its asset purchases, as many had expected.

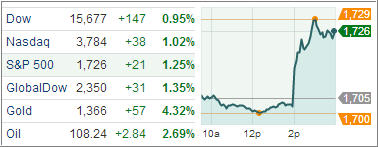

The S&P 500 jumped 1.2%, erasing an earlier decline of as much as 0.3 percent and closing at a record high of 1,725.52. Trading volume today reached a one-month high. Meanwhile, investors digested a softer-than-forecasted read on U.S. housing construction, which overshadowed a rebound in domestic mortgage applications, while Treasury yields were lower.

Although the Federal Reserve did not make a tapering announcement, the policy statement did contain updated economic projections. Notably, the forecast for 2013 and 2014 GDP was lowered with the Committee expecting this year’s growth between 2.0% and 2.3% (2.3%-2.6% June forecast) and 2014 growth ranging between 2.9% and 3.1% (3.0%-3.5% June projection). Mr. Bernanke said economic data received since June has not been strong enough to justify scaling back asset purchases just yet. The Fed Chairman also said that recent tightening of financial conditions, as well as the ongoing fiscal uncertainty, played a part in the decision to maintain asset purchases.

Treasuries and precious metals also welcomed the lack of a tapering announcement. The 10-yr note rallied to push the yield down to 2.71%. Meanwhile, gold spiked 4.4% and silver surged 6.1%. Miners also received an afternoon boost, and the Market Vectors Gold Miners ETF settled higher by 9.0%.

On a related note, the materials space ended ahead of the remaining cyclical sectors, posting a gain of 2.3%. The other commodity-related sector, energy (+1.2%), settled in-line with the S&P even as crude oil surged 2.6% to $108.12 per barrel.

Transportation companies appeared largely unaffected by the sharp gain in crude as the Dow Jones Transportation Average climbed 1.5%. Five of six cyclical sectors ended ahead of the broader market while financials (+1.0%) underperformed. Countercyclical sectors ended in mixed fashion as health care (+0.7%) and telecom services (+0.4%) lagged while consumer staples (+1.3%) and utilities (+3.0%) outperformed.

Housing starts for August rose less than forecasted at 0.9% m/m to an annual pace of 891,000 units. Moreover, building permits fell 3.8% m/m in August.

Of course, we all know that the absence of “tapering” means that the economy is in far worse shape than is officially admitted. Nevertheless, we don’t concern ourselves with the daily onslaught of news and its variety of interpretations. All we care about is the direction of the major trends as represented by our Trend Tracking Indexes (TTIs).

Both of them joined the party and rallied deeper into bullish territory. The Domestic TTI closed the day at +3.96% while the International TTI ended at +8.88%.

Contact Ulli