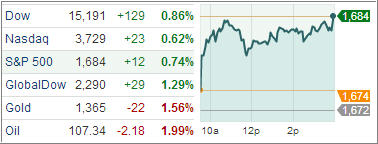

Amid more upbeat global economic news and concerns over a U.S.-led strike on Syria continuing to wane, U.S. equities closed with solid gains as the S&P 500 advanced for the sixth straight session. Chinese economic data showed stronger-than-anticipated reads on industrial production, retail sales and lending activity, while Syrian Foreign Minister announced that the country has agreed to Russia’s proposal to put its chemical weapons under international control.

On the equity front, Goldman Sachs, Visa and Nike jumped more than 2.1 percent as the three companies will be added to the Dow Jones Industrial Average, replacing Bank of America, Hewlett-Packard and Alcoa.

Stocks registered the bulk of their gains during the opening hour after China’s industrial output rose 10.4 percent in August from a year earlier and the nation’s retail sales gained 13.4 percent. Both results exceeded economists’ estimates. Equities also climbed yesterday as China’s exports topped forecasts. Meanwhile, new developments about Syria reduced risk for financial markets.

Shares in companies whose earnings are most closely tied to economic growth rose, sending the Morgan Stanley Cyclical Index up 1.7 percent to the highest level since the gauge started in 1978. Industrials (+1.4%) ended in the lead thanks to all-around strength. The largest sector member, General Electric rose 2.1% and transportation companies also rallied across the board. The Dow Jones Transportation Average climbed 1.9%.

Industrials were followed by the financial sector, which gained 1.2%. Technology (+0.6%) traded in-line with the S&P through the first half of the session, but was pressured by Apple during afternoon trade. The iPhone producer lost 2.3% after its product refresh event was met with investor disappointment.

With regard to countercyclical sectors, consumer staples (+0.1%) and health care (+0.6%) lagged while utilities (+0.7%) ended in-line. The weakest group of the third quarter, telecom services (+1.1%), narrowed its quarter-to-date loss to 5.1%.

Our Trend Tracking Indexes (TTIs) inched deeper into bullish territory with the Domestic TTI closing at +2.10% while the International TTI ended the day at +6.23%.

Contact Ulli