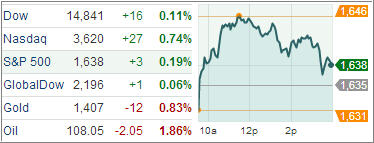

Domestic equities managed to close higher for a second straight session, despite an afternoon stumble, thanks to a solid read on the pace of U.S. economic growth and weekly jobless claims remaining near 5-year lows, while the immediate threat of military action against Syria diminished slightly.

Meanwhile, gold and crude oil retracted from their recent rally, while the U.S. dollar and Treasuries gained ground. Stocks found further support from a potential major M&A announcement in the telecom sector as Vodafone confirmed talks with Verizon regarding a sale of its stake in Verizon Wireless, a potential $130 billion deal.

As the result, telecom services finished in the lead as the sector advanced 1.2%. Eight of ten sectors posted gains on Thursday. Technology also displayed notable strength as top-weighted components like Google and Microsoft climbed 0.8% and 1.6%, respectively. High-beta chipmakers also rallied as the PHLX Semiconductor Index rose 1.2%. The outperformance of technology combined with strength among biotechnology companies helped the Nasdaq finish well-ahead of the broader market.

On the downside, energy (-1.1%) and utilities (-0.5%) were the only two decliners. Weighing on energy shares was crude oil, which tumbled 1.9% to $107.98 per barrel. With tomorrow being the final session of the month, the utilities space is poised to finish August behind the remaining nine sectors with a loss of 5.6%.

Equities slipped during the final hour of action amid comments from St. Louis Fed President Jeffrey Lacker who said, “Conditions for tapering QE have been met.” Technical factors may have also played a part in the afternoon retreat as the S&P was pressured back below its 100-day moving average.

Prior to the open, investors received the news that Q2 GDP was revised up to a 2.5% annual rate from 1.7% in the advance estimate, above the consensus of 2.2%. Analysts believe that we will see some lift in economic growth, driven by improving exports, rising capex and the still-recovering housing market; but growth is likely to remain relatively weak.

Elsewhere, investors in U.S.-based funds pulled $863.1 million out of stock funds in the latest week, down from massive outflows in the prior week even as geopolitical risk shook markets, according to Thomson Reuters. While outflows from stock funds overall eased, the SPDR S&P 500 ETF Trust (SPY) still had $1.3 billion in outflows. The exchange-traded fund fell 0.5 percent over the weekly period.

Our Trend Tracking Indexes (TTIs) inched slightly higher with the Domestic TTI reaching +1.34% while the International TTI settled at +3.39%.

Contact Ulli

Comments 2

Uli I do like your daily commentary. You give out stats with percentage changes, etc, etc. I the think it would be also helpful if you included the % changes or numeric changes in the TTI figures too on a daily basis and a monthly then a quartwerly basis too.. Or are we to keep tabs on a paper of the daily changes ion the TTI’s.

Sincerely Frank B

Frank,

The TTI’s do not move very fast, so you only have to monitor them about once a week. This is why I include the weekly change in every Friday’s commentary. For a longer term view, you can always look at the charts in Thursday’s StatSheet.

Once any of the TTI’s drop below their respective +1% level, I suggest you follow it more closely so you don’t miss the sell signal.

Ulli…