The major U.S. equity index ETFs finished modestly lower, pulling back before this week’s Federal Reserve meeting that could signal when the Fed is going to begin reducing its bond purchases aimed at helping the economic recovery. Key upcoming events kept traders at bay, with Wednesday’s Fed policy decision and Friday’s U.S. nonfarm payroll report looming on the horizon. Stocks began the session in the red after the third consecutive decline in Japan’s equities contributed to the cautious sentiment.

Stocks in Asia finished mostly lower to begin the week amid Chinese economic concerns and a sharp sell-off in the Japanese markets. The Nikkei 225 Index fell on broad-based weakness, led by export-related issues in the wake of a gain in the Japanese yen, which hit a one-month high versus the U.S. dollar.

Moreover, stocks came under pressure following a report that showed Japan’s retail sales unexpectedly declined m/m in June. Additionally, a report showed growth in China’s industrial profits slowed in June. Meanwhile, deterioration in South Korea’s manufacturing sector sentiment pressured the Kospi Index.

Here at home, pending home sales edged down 0.4% in June, contrary to expectations for a slight 0.1% uptick. According to the report, higher mortgage rates and low inventory weighed on contract signing activity last month. Even so, pending sales are 10.9% above a year ago and remain near the highest level in six years.

Meanwhile, Texas factory activity grew at a slower pace in July, as the general business activity index slipped 2.1 points to +4.4, while the company outlook index fell 8.8 points to +4.5. The outlook for the next six months was slightly less optimistic than last month. Interestingly, industrials (-0.3%) finished ahead of the S&P despite the underperformance of transportation-related names.

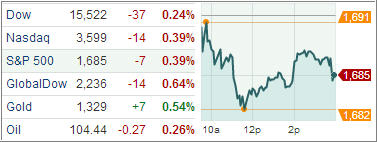

Consumer discretionary, energy, and financial sectors lost between 0.6% and 0.8% with energy leading to the downside. The energy space fell 0.8% as crude oil endured a volatile session, alternating between gains and losses before ending lower by 0.3% at $104.42 per barrel.

The Materials sector was the only cyclical group to settle in the green. Elsewhere, the underperformance of all major banks weighed on the financial sector, which shed 0.8%. Also of note, discretionary shares displayed broad weakness.

Besides the Fed’s statement, which is due on Wednesday along with July’s payrolls report, investors will also watch this week’s earnings from more than 130 companies listed on the S&P 500. Of the 269 companies in the S&P 500 that have posted results so far this earnings season, 73 percent have exceeded analysts’ estimates for profit and 56 percent have beaten sales projections, data compiled by Bloomberg show.

Trend wise, today’s pullback only had a small effect on our Trend Tracking Indexes (TTIs) with the Domestic TTI slipping to +3.13% while the International TTI ended up at +6.10%.

Contact Ulli