A day after Chairman Ben Bernanke said the Federal Reserve will keep a loose monetary policy for some time to lower the unemployment rate, U.S. equity markets advanced to record highs at the close of Thursday’s session. Apparently, we must have misunderstood Bernanke’s previous remarks of tapering, as he has now successfully pushed the jelly back in the donut.

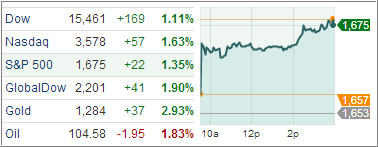

The S&P 500 index topped the closing record of 1,669.16 reached May 21, erasing losses since Bernanke first suggested the Fed might curb stimulus this year. The Dow Jones Industrial Average also jumped to a record close. More than 85 percent of shares on the New York Stock Exchange and almost 70 percent of those on the Nasdaq rose on Thursday. All 10 of the S&P 500 industry sectors advanced, with five of them rising more than 1.5 percent.

In economic news, jobless claims surprisingly rose above the key level of 350,000 and import prices unexpectedly declined. Data today showed the number of Americans filing for unemployment benefits unexpectedly increased to a two-month high. Swings in jobless applications are typical in July as auto plants close for annual retooling. The Labor Department last week released its jobs report for the month of June, showing the economy added 195,000 jobs, exceeding estimates, while the unemployment rate was unchanged at 7.6 percent. Additionally, equities found support from overseas, as the Bank of Japan issued an upgraded economic outlook, while hopes regarding the prospect of further Chinese economic stimulus continued to rise.

Bernanke’s remarks calmed concerns in the Treasuries market, and stock investors flocked to housing-related stocks on bets on a decline in mortgage rates. The PHLX housing index jumped 4.9 percent, its largest daily gain since Dec. 20, 2011. D.R. Horton jumped 9.2 percent and at least six other homebuilder stocks rose 7 percent or more. So what is next for stocks?

Investors will now turn their attention to earnings season, which was unofficially kicked off this week with Aloca outperformed analyst’s estimates. Wells Fargo and JP Morgan will report their earning ahead of the opening bell tomorrow. The next targets traders are eyeing on are those intraday record highs that were set in May 22 on both the Dow and the S&P 500. China’s economy, however, is posing a threat. Analysts are worried next week second-quarter numbers could show further contraction. A market correction could be a distinct possibility.

In the meantime, our Trend Tracking Indexes (TTI) rallied with the overall market with the Domestic TTI reaching +3.14% and the International TTI settling at +6.60%.

Contact Ulli