U.S. equities shed earlier losses and closed the trading session in positive territory, allowing stocks to snap their recent two-day losing streak and avoid giving the Dow its first three-session decline of the year.

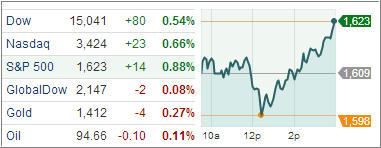

The Dow Jones Industrial Average added 80 points (0.5%) to 15,041, the S&P 500 Index moved 14 points (0.8%) higher to 1,622, and the Nasdaq Composite increased 23 points (0.7%) to 3,424.

The Dow today slipped below its 50-day moving average of 14,923.91. That was the first time this year it happened for the 30-stock gauge. The S&P 500 also spent the first half of today’s session attempting to climb above yesterday’s afternoon highs. However, around midday, the index briefly slipped below its 50-day moving average of 1,604 – the first time the benchmark has dropped below that technical level since April 18.

By mid-afternoon, the S&P reversed course and ended the day up 0.9 percent. Cyclical sectors were whipsawed early in the session, but the afternoon advance helped five of the six growth-oriented groups register gains. The session’s best performers included financials and health care, with each ending up 1.4 percent. Homebuilders rallied broadly after displaying notable softness over the past few sessions.

The only significant economic release ahead of tomorrow’s nonfarm payroll report was the initial claims for unemployment insurance which fell 11,000 to 346,000 last week, slightly below the consensus of 345,000. Increased data volatility this year reflects the choppy labor market recovery. The four-week average of claims rose 4,500 to 352,500, and remains consistent with moderate growth in nonfarm payrolls.

Elsewhere, the RBC Consumer Outlook Index rose 1.6 points in June to 51.8, the highest level since October 2007. All index components improved. The 12-month averages of the overall index and all its components continue to rise, indicative of a positive trend in consumer attitudes.

The European equity markets finished lower, as the Bank of England and the European Central Bank both kept their benchmark interest rates unchanged, as expected, at 0.50%.

Elsewhere, a report showing German factory orders fell more than expected in April, and the 1Q French unemployment rate moved higher to 10.8%, adding to the pressure on stocks.

Tomorrow, all eyes will be turned to the May nonfarm payrolls report, along with unemployment rate. These results will sure bring up more speculation on future Fed policy.

Whenver I see a last hour rebound out of the blue sky the day before a major economic report, it makes me wonder if there was some leakage. We may never know, but a positive NFP report might support this thesis.

Be that as it may, our Trend Tracking Indexes (TTIs) recovered and closed up after slipping during the past few trading days. The Domestic TTI ended the day at +2.82%, while the International TTI reached the +5.68% level.

For updated charts and the most recent momentum figures, please see my latest StatSheet, which I will post within a couple of hours.

Contact Ulli