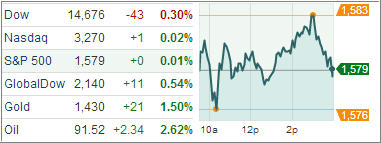

Investors are left with little convictions as a result of disconcerting earnings results and a disappointing read on US durable goods orders. The market closed marginally lower at the Dow while extended gains in the Standard & Poor’s 500 Index to a fourth day.

More than three stocks rose for every two that fell on U.S. exchanges as 6.3 billion shares traded hands, in line with the three-month average. The market’s mixed day followed strong gains early this week. The S&P 500 is still up 10.8 percent for the year despite a fairly weak month. Healthcare sector index fell 1.2 percent and was the worst performer among the S&P’s 10 sectors.

In earnings news, Apple’s drop in its gross margin overshadowed the company’s better-than-expected earnings. Dow members AT&T and Procter & Gamble, along with Yum! Brands posted mixed results. P&G fell 4.8 percent after the biggest U.S. household goods manufacturer issued a profit outlook that was below expectations. It was the stock’s biggest drop since January 2009.

Elsewhere, Dow member Boeing’s profits easily exceeded forecasts, while Ford Motor bested analysts’ expectations. According to data compiled by Bloomberg, projections for the second quarter were lowered by most analysts, forecasting earnings to expand 5.5 percent, down from 6.2 percent at the beginning of April. This is to make sure that mainstream media can continue its positive spin on earnings results.

In economics news, orders of durable goods fell 5.7% in March, down in two of the past three months, and by the most since August. Economists expected a smaller 2.9% drop. The decline in March was led by civilian aircraft, down 48.2%, reflecting fewer orders for Boeing airplanes. Nonetheless, nondefense capital goods orders excluding aircraft ticked up 0.2%. Notably, computers and electronic products advanced 1.0%, its first increase this year.

Elsewhere, mortgage applications stayed roughly flat. The MBA Mortgage Application Index rose 0.2% last week, after an increase by 4.8% in the previous week. The slight advance in mortgage activity came as the average 30-year mortgage rate declined 2 basis points to 3.65%.

Stocks have suffered declines during the second quarter in each of the past three years, with losses in the S&P 500 averaging 5.2 percent. Will the trend continue due to slow economic growth?

That is the big unknow and one of the many reasosn why I continue to harp on the use of trailing sell stops. The markets have come a long way for no other reason than the open ended stimulus program by the Fed. Surely, this upward momentum is clearly unsustainable, and you have to consider the possibility of a correction.

Right now, however, our Trend Tracking Indexes (TTI) are still bullish with the Domestic TTI showing a positon of +3.55% and the International TTI hovering at the +7.34% level.

We will continue to hold all positions subject to our trailing sell stops.

Contact Ulli