US equities headed sharply downhill, with benchmark indexes sliding to their lowest levels in more than five weeks as oil prices plunged and labor market data disappointed, spurring concern on economic growth ahead of Friday’s all-important nonfarm payrolls report.

Before markets opened, New Jersey-based private payroll-processor ADP Research Institute reported companies hired 158,000 workers in March, well below expectations for a 200,000 increase and versus an upwardly revised gain of 237,000 in February.

The data came before Friday’s non-farm payrolls report from the Labor Department, which is expected to show employers hired about 195,000 workers for the month.

Equities continued their slide after the release of a gauge of the US services sector. The Institute for Supply Management’s index of non-manufacturing businesses, which covers almost 90 percent of the economy, slipped to 54.4 in March from 56 the month before.

Stocks came under further pressure after Federal Reserve Bank of San Francisco President John Williams on Wednesday said the central bank could taper its $85 billion-a-month assets-purchase by the summer. St. Louis Federal Reserve Bank President James Bullard had earlier argued in favor of paring the bond purchase program in $10-$15 billion increments in response to improvements in the economy.

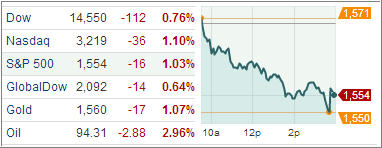

After a steep 137 point decline, the Dow Jones Industrial Average (DJIA) finished 112 points lower while the S&P 500 Index (SPX) shed 16 points after touching an all-time high yesterday, with financials hitting the ground hardest and technology losing the least among its 10 business sectors.

Treasuries climbed, pushing the benchmark 10-year yields to the lowest level in nearly three months as weak US services-sector and employment data spurred demand for safer assets.

The US dollar weakened against major rivals after economic data missed estimates, raising doubts about the economy’s recovery.

European stocks declined the most in five weeks on Wednesday after posting the biggest rally yesterday by the region’s pan-European index as US companies added fewer workers than estimated and the services industry showed signs of slowdown.

The Stoxx Europe 600 index trimmed 0.9 percent, partly erasing yesterday’s 1.3 percent jump.

Investors also awaited policy decisions by the European Central Bank and the Bank of England tomorrow. Both banks are expected to hold rate cuts. The ECB expects the economy to improve in the medium term and as the monetary transmission mechanism remains broken, a rate cut is unlikely to benefit the real economy.

The mood was lifted briefly after Cyprus completed an agreement with the International Monetary Fund for one billion euros in aid in addition to the EUR 9 billion committed by euro-area institutions.

Whether today’s pullback was just a one day event or the beginning of a long overdue corrections remains to be seen. Our Trend Tracking Indexes (TTIs) gave back some of yesterday’s gains and closed the day as follows:

Domestic TTI: +3.04%

International TTI: +6.29%

Friday’s payroll report will certainly have a short-term impact on equity prices, but we have to wait and see if the Fed’s relentless money printing efforts will supersede the negative a poor jobs report will have on the indexes. In any event, there is no sense in making wild guesses; we will simply remain alert to our trailing sell stops.

Contact Ulli