The major index ETFs finished marginally lower Monday on the lightest volume trading day of 2013 as investors took a breather after the recent rally and reassessed the markets that have pushed the S&P 500 and the Dow Jones near all-time highs.

With no significant economic and corporate-earnings news to chew on, markets took a pause Monday, recording the year’s lowest trading volume. Most Asian markets remained closed on account of Lunar New Year celebrations, eliminating one more possible bullish driver.

Finance ministers from the 17-member euro-area met in Brussels today to discuss aid to Cyprus and Greece as concern over the region’s debt crisis revived following political turmoil in Spain and Italy.

Separately, news reports suggested officials from Group of Seven nations were considering of issuing a statement aimed at averting a so-called currency war. Reuters reported a G-7 statement could be released ahead of the meeting of G-20 finance ministers and central bankers in Moscow this week.

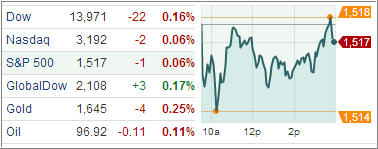

The Dow Jones Industrial Average (DJIA) shed 22 points while the S&P 500 Index (SPX) declined fractionally.

Treasuries traded in narrow range as traders refrained from taking large positions ahead of the US government’s $72 billion coupon-bearing securities sales this week prepared for a possible statement from the Group of Seven leaders on the so-called currency war ahead of the G20 meeting in Moscow on Friday.

The US dollar gained against majority of its 16 most-traded rivals Monday after Media reports suggested the Group of Seven leaders were considering issuing a joint statement aimed at lowering investor concern over the so-called currency war.

The euro, however, rallied against the dollar to 1.3424 after Jens Weidmann, president of the German Bundesbank and member of the European Central Bank’s governing council, said there is no evidence the euro is overvalued and warned against any government intervention to weaken the currency.

Meanwhile, European equity averages dropped on Monday after Novo Nordisk sank 14 percent following regulatory setback for a new drug. Energy and mining stocks were the hardest hit as commodity prices slipped while political uncertainty in Spain and Italy weighed on the region’s banks.

The Stoxx Europe 600 index slipped 0.6 percent to 285.62 even as European finance ministers resumed their discussions in Brussels over extending aid to Cyprus and Greece.

European Central Bank executive board member Joerg Asmussen told German daily Handelsblatt that a rescue package for Cyprus won’t be ready before March and warned the tiny country may renew euro-zone crisis.

Amid Monday’s notable movers, world’s largest insulin maker Novo Nordisk crashed 14 percent after the US FDA requested the Danish drug-maker to conduct more tests on its key insulin drug, potentially delaying the approval by several years.

It was a slow day, and our Trend Tracking Indexes (TTIs) followed suit by barely budging with the Domestic TTI slipping to +3.15% while the International TTI settled at +10.77%.

Contact Ulli