US equity indexes mostly finished lower with the S&P 500 snapping its longest rally since 2004 as a decline in pending home sales offset a rise in durable-goods orders while investors seemed reluctant to make fresh purchases after four weeks of gains.

The Commerce department said orders for durable goods rose 4.6 percent in December after a paltry 0.7 percent gain in the previous month. Stocks however, gave up the gains after a report by the National Association of Realtors showed pending home sales dropped 4.3 percent last month.

Caterpillar rose two percent after the equipment maker forecast stronger growth in the second half of the year while fourth-quarter profit sank 55 percent due to write-down.

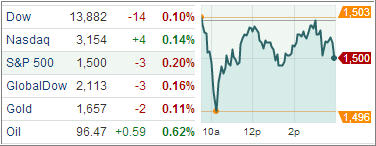

The S&P 500 Index (SPX) slipped 3 points to end at 1500 with materials hitting the ground hardest and technology gaining the most among its 10 business groups.

Bucking the trend, the tech-heavy NASDAQ Composite index (COMP) added 4.59 points, helped by the benchmark’s oversized component Apple Inc. The smartphone maker gained 2.3 percent after its worst weekly slump since 2008.

Treasury prices dropped, pushing yields on the benchmark 10-year notes briefly above the two-percent mark for the first time since April after robust durable-goods sales data in December boosted investor risk appetite.

In the ETF space, the Van Eck Market Vectors Gold Miners ETF (GDX) fell 1.05 percent after shedding 2.99 percent and 2.89 percent on Thursday and Friday, respectively. The State Street SPDR Gold Trust (GLD) also shed 0.22 percent as the yellow metal lost the allure of safe-haven asset following a raft of positive economic news last week.

Our Trend Tracking Indexes (TTIs) backed off their highs a little with the Domestic TTI closing at +2.99% while the International TTI ended up at +10.92%.

Contact Ulli