US stocks turned lower, sending the major equity averages down for a second straight day, as Democrats stuck to their guns on raising taxes for the richest Americans and eurozone differences continued to fester over a new banking regulator in the single currency bloc.

In the latest round of US budget negotiations, the White House rejected a Republican offer for tackling the fiscal cliff that omitted higher tax rates for top earning Americans. President Obama had proposed $1.6 trillion in new taxes last week to bring down the budget deficit by $4 trillion over the next decade. Republicans made a counter offer Monday that included tax reforms and changes to Medicare and other spending cuts worth $2.2 trillion over the next decade.

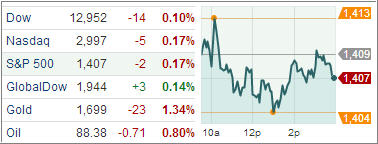

The Dow Jones Industrial Average (DJIA) fell 14 points, extending losses into the second session. Breadth turned slightly negative with decliners outnumbering winners 16 to 14. The S&P 500 Index (SPX) shed 2 points with telecommunications faring the worst and industrials fronting the gains among its 10 business groups.

Treasuries advanced Tuesday as uncertainties surrounding the US fiscal cliff and a single banking regulator in the euro area continued to weigh on investors, increasing the allure of safer assets. Despite the agreement for better integration among the region’s banks, European leaders have squabbled over the details for a single banking regulator in the region.

German Finance Minister Wolfgang Schaeuble questioned if it was realistic to believe one institution would be able to supervise thousands of banks across the region adding that it would be tough to get a go-ahead from the German parliament on such a plan.

The benchmark 10-year yield, which moves inversely to prices, fell two basis points to 1.61 percent while yield on the 30-year Treasury bonds dropped three basis points to 2.78 percent.

The US dollar weakened on Tuesday while the Australian rallied on signs the country’s central bank may halt the easing cycle. The Reserve Bank of Australia cut its benchmark rate a quarter point to a new crisis era low.

European stocks meanwhile struggled for cues as investors kept an eye on the US budget negotiations between the Republicans and the Democrats. After swinging between gains and losses throughout Tuesday, the Stoxx Europe 600 index finished slightly higher.

Separately, a Deutsche Bank note predicted 2.5 percent growth for the US economy in 2013. A global growth of 3.5 percent will drive a six percent growth for the Stoxx 600 in 2013, the analysts at Deutsche Bank noted; he added that cyclicals would continue to outperform defensive stocks into the next year.

The DAX 30 index closed fractionally lower in Frankfurt after a 3.8 percent slump in Infineon Technologies offset gains in bank stocks. Deutsche Bank AG added 1.8 percent while Commerzbank AG rose 1.5 percent.

The CAC 40 index rose 0.4 percent in France, lifted by banks Societe Generale SA and Credit Agricole SA. Both the stocks added more than two percent for the day.

The FTSE 100 index closed slightly lower in London, pulled down by oil firms BP Plc and Royal Dutch Plc as oil futures tumbled after recent gains.

Our Trend Tracking Indexes (TTIs) changed only slightly due to the tight trading range with the Domestic TTI now hovering at +1.85%, while the International TTI is positioned at +4.92%.

For quick access to the most recent StatSheet including TTI charts and all momentum figures, click here. You can read the latest ETF Model Portfolio update here.

Contact Ulli