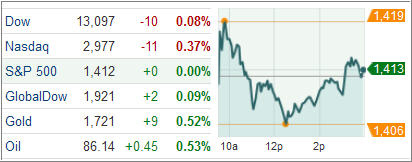

US stock indexes logged their first monthly loss since May with the S&P 500 retreating 2.01%, capping a weak month on a mixed note Wednesday after markets reopened following a two-day closure due to super-storm Sandy.

Economic data was relatively light with the Chicago Purchasing Manager’s Index data for October printing at 49.9 from 49.7 in the prior month, still in the ‘contractionary’ region and signaling weakness in the manufacturing sector for the second straight month. Readings above 50 indicate expansion.

Stocks in the construction and housing sectors are likely to rise due to the massive rebuilding that will follow after Hurricane Sandy. However, odds are insurance companies will suffer as markets try to figure out the earnings hit the sector will take in the fourth quarter.

Treasury prices headed higher, pushing yields on 10-year notes lower on worries the massive storm will slowdown growth in the fourth quarter. Yield on the benchmark 10-year Treasury notes fell three basis points to 1.69 percent while 30-year Treasury bonds erased earlier gains to end little changed.

The US dollar meanwhile pared most of its losses as demand for safer assets spiked after equities ended in the negative region. The ICE dollar index, a measure of the greenback’s worth against a basket of six currencies, closed at 79.903 from 79.942.

European stocks finished lower following a choppy trading session as early gains from the oil and airlines sectors were offset after US equities turned lower across the Atlantic. The Stoxx Europe 600 index fell 0.5 percent, but managed to eke out a 0.7 percent gain for October.

Euro area joblessness continued to disappoint with September unemployment rate hitting a fresh high of 11.6 percent from 11.5 percent in August.

Greece hit the headlines today after the 2013 budget bill showed the economy contracting by 4.5 percent from an earlier estimate of 3.8 percent. Debt-to-GDP ratio was also expected to rise to 189.1 percent from 179.3 percent expected earlier.

The National Bank of Greece slipped 2.7 percent, dragging the Athens General Index down by 1.7 percent.

The German DAX 30 index shed 0.3 percent, still up 0.6 percent for the month. Tire maker Continental AG slipped 2.7 percent.

Up 2.2 percent for the month, the CAC 40 index dropped 0.9 percent after oil major Total SA finished 0.4 percent lower for the day.

The FTSE 100 index tumbled 0.7 percent in London after BG Group Plc warned of stagnating production in 2013. The index added 0.7 percent for the month.

Our Trend Tracking Indexes (TTIs) closed the month of October on the bullish side of the trend line:

Domestic TTI: +1.48%

International TTI: +2.74%

A host of economic indicators may get the markets moving tomorrow, but the main attraction will be Friday’s non-farm payroll and unemployment report.

Contact Ulli