US equities managed modest gains Wednesday after a four-year high new-home construction data offset disappointing earnings results from technology bellwethers like IBM and Intel. It’s simply amazing to me that good data points (housing starts being one of them), way out of the range of normal, have appeared recently, very conveniently just prior to the elections.

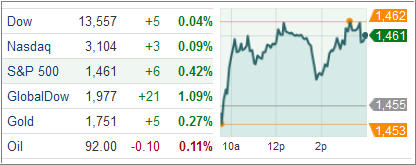

It makes me wonder if there will be a market hangover once the election ordeal has finally passed and some reality as to the status of the real economy starts to sink in. Be that as it may, extending gains into the fourth session, the Dow Jones Industrial Average (DJIA) added 5 points. International Business Machines (IBM) witnessed the steepest fall, losing 4.9 percent, after Q3 revenues fell short of expectations. Breadth within the 30-component index traded positive with 23 stocks turning higher.

Shares of homebuilders surged after a Commerce Department report showed housing starts jumped 15 percent to an 872,000 annual rate last month, the most since July 2008 and better than what economists had predicted.

Extending its winning streak into the third straight session, the S&P 500 Index (SPX) climbed 6 points with utilities pacing the gainers and technology lagging among its 10 business groups.

Treasuries were trading lower for the third straight session, the longest in almost six weeks, as US housing continued to show strength. The benchmark 10-year yield hit the highest level in almost a month after ratings agency Moody’s reaffirmed Madrid’s investment-grade status late Tuesday, saving the Iberian nation from joining the league of Portugal, Greece and Ireland, all of which were downgraded below investment-grade.

Madrid faces lower risks of losing access to the capital markets due to the European Central bank’s readiness to buy Spanish bonds.

The euro jumped to a month high against the greenback Wednesday as risk sentiment got a boost ahead of Thursday’s EU summit in Brussels after Moody’s held Spanish government debt a notch above junk grade.

Spain lifted European stocks higher with the pan-European Stoxx Europe 600 index rising 0.5 percent Wednesday, posting its third straight session of gains.

Both stock and bond markets rallied in Madrid with the 10-year yield plunging 32 basis points to 5.45 percent, the lowest since April. The IBEX 35 index jumped 2.4 percent, lifted by the banking sector.

Risk sentiment got further support from the UK after the country’s unemployment rate declined to a 15-month low of 7.9 percent in the three months ending in August. UK stocks finished mostly higher with the FTSE 100 adding 0.7 percent in London.

In Germany, the DAX 30 index climbed 0.3 percent after Lanxess AG edged up 2.8 percent as Nomura shortlisted the chemical maker as one of its sector favorites.

In the ETF space, the better-than-expected housing starts number triggered a rally in the homebuilder-linked funds. The iShares Dow Jones U.S. Home Construction Index Fund (ITB) surged 2.94 percent while the State Street SPDR Homebuilders ETF (XHB) rose 1.93 percent. The State Street Financial Select Sector SPDR added 1.31 percent on the day.

Disclosure: No holdings

Contact Ulli

Comments 2

Ulli,

Do you calculate the Trend Tracking Index (TTI) on a daily basis or is it just done once per week when you post the Stat Sheet? If it is calculated daily, is there somewhere on your website where it is posted?

Thanks for your good work. I find it very useful as confirmation or not vs. my own work and analysis.

Best Regards,

Ken

Ken,

Yes, the TTIs get recalculated on a daily basis, but their respective moving averages (M/As) get recalculated only on Friday. So, when I publish Friday’s numbers, they include Friday’s price and the latest M/As.

Ulli…