US stocks lost traction Monday with the S&P 500 extending losses over the weekend for the third straight day as data from China and Germany indicated global recovery is slowing while Europe squabbled over the deadline of proposed banking oversight system.

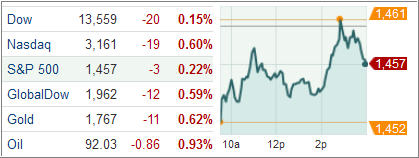

The Dow Jones Industrial Average (DJIA) lost 21 points while the S&P 500 Index (SPX) fell 3 points with technology hitting the ground hardest and utilities outperforming among its 10 business groups.

Treasury yields fell as prices rose for the sixth session in a row after German news agency Der Spiegel reported that Greece’s budget deficit has been estimated at EUR 20 billion by the so-called Troika of the European Commission, the ECB and the IMF, nearly double than previous estimates.

Furthermore, disagreement between Berlin and Paris over the proposed pan-European banking oversight authority underlined the implementation risks the region faces. Ah yes, the infighting goes on…

Meanwhile, the US dollar strengthened against the euro as investors grew anxious over the effectiveness of recent policy measures in Europe to tide over the financial crisis. The dollar index, a gauge of the greenback’s strength against a basket of six global currencies, rose to 79.573 from 79.323 in late trade on Friday.

Across the Atlantic, European stocks finished mostly lower as disappointing German data and worries over Spain and Greece spooked markets. The Stoxx Europe 600 index lost 0.4 percent after the Ifo index, a gauge of German business confidence, slumped for the fifth month in September, beating analysts’ expectations.

Spain’s IBEX 35 index gave up 1.1 percent on the day, dragged down by banks Banco Santander SA and BBVA SA.

Banking stocks weighed on German stocks as well with the DAX 30 index tumbling 0.5 percent, dragged down by Commerzbank AG and Deutsche Bank.

France CAC 40 index lost one percent after index-component ArcelorMittal lost 2.3 percent. Bank stocks also came under pressure with Credit Agricole and BNP Paribas losing 2.4 percent and 1.5 percent respectively.

Miners were hit the hardest in the UK with Anglo American Plc, Rio Tinto and BHP Billiton on the FTSE 100 slipping the most after metal prices eased on Monday on growth worries.

In the ETF space, commodity futures-linked funds retreated as European economic gridlock continued on Monday. Base and precious metals, energy prices and agricultural goods all sank for the day.

The Van Eck Market Vectors Junior Gold Miners ETF (GDXJ) was one of the biggest percentage decliners, slipping 4.32 percent after gold futures fell 0.8 percent to $1764.60 an ounce. The Van Eck Market Vectors Gold Miners (GDX) also traded crashed, shedding 3.38 percent on the day.

Disclosure: No holdings

Contact Ulli