Equity ETFs took a breather to close lower Monday as last week’s Fed stimulus-driven euphoria faded after a disappointing New York area manufacturing data forced investors to mull over the health of the economy. Maybe some of the realization is sinking in that all is not well as markets have chosen to ignore economic fundamentals by focusing too much on the Fed’s spiked punchbowl.

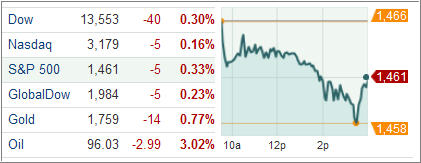

After a four-day winning streak, the Dow Jones Industrial Average (DJIA) fell 40 points and the S&P 500 Index (SPX) slipped 5 points with natural resources and financials declining the most and telecommunication and healthcare outperforming among its 10 business groups.

US Treasuries started the week on a winning note after a four-day losing streak as a New York area factory-output gauge slumped to -10.41 this month from -5.85 in August, increasing investor appetite for safe-havens. The gauge, known as the Empire State Index, is at its lowest since April 2009, underscoring Bernanke’s concern that more monetary stimulus may be required to halt the slowdown.

Yield on the benchmark 10-year notes declined four basis points to 1.83 percent over media reports that the European Union finance ministers failed to reach a consensus on a timetable for a more integrated banking sector and squabbled over the role of the ECB and future terms of rescue request at its September 14 meeting in Cyprus.

Meanwhile, the euro continued to gain traction Monday, rallying against the US dollar and the Japanese yen following escalation of tensions between China and Japan over small islets in the East China Sea.

European stocks pulled back from last week’s Fed-inspired 15-month high following weak performance by telecommunications and mining firms. The Stoxx Europe 600 gave back 0.3 percent after the markets reacted strongly to the US Fed and the German Constitutional Court’s decision on the ESM last week.

Spain’s IBEX 35 came under pressure after tens of thousands protested over proposed spending cuts over the weekend. Reversing last week’s trend, the Spanish 10-year borrowing costs rose 17 basis points to 5.95 percent today, indicating investors won’t wait indefinitely for Madrid to seek formal help from the ECB.

Elsewhere in the ETF space, agricultural commodities got hammered as better than expected crop yield triggered a near sell-out across the board.

The Barclays iPath DJ-UBS Grains Total Return Sub-Index ETN (JJG) crashed 4.85 percent while the Teucrium Corn Fund (CORN) tumbled 3.78 percent. Energy-related funds also tanked after oil futures lost close to $3/barrel in today’s trading. The Unites States Oil Fund (USO) and the United States Natural Gas Fund (UNG) shaved 2.96 percent and 2.56 percent respectively.

The iShares Barclays 20 Year Treasury Bond Fund (TLT) emerged among the best performers, adding 1.2 percent on the day as gridlock in Europe again hit the headlines, forcing investors to rush for safe havens.

Disclosure: Holdings in TLT

Contact Ulli