The US dollar has not really rallied against the euro despite the European debt crisis continuing to dominate global headlines. In fact, the US dollar has remained nearly flat so far in 2012, as indicated by the US dollar index reading (see UUP chart above).

Many investors, however, remain long-term bearish on the world’s leading reserve currency due to a string of macroeconomic factors that currently plague the US economy.

The economy remains highly leveraged, both at the individual, state and federal level while inflation, driven by high energy costs pose significant risks to growth as the Federal Reserve may be forced to raise interest rates to cap rising prices.

More analysts are advising investors to either spread their currency risks or try taking advantage of alternative currencies against the dollar. If you are taking long term positions, or are trying to remove some of the currency risks, you can consider these short-dollar currency ETFs.

WisdomTree Dreyfus Emerging Currency Fund (CEW):

Those who are betting big on emerging markets and expect their currencies to strengthen against the US dollar, a look at a basket of developing market currency such as CEW can be an interesting proposition.

This ETF is heavily skewed towards Asian economies (42 percent), although Europe, Latin America, and the MENA (Middle East and North Africa) region is adequately covered, each contributing at least 16 percent by weight. The CEW’s currency basket approach reduces volatility and provides adequate safety through diversification.

The fund has an annual expense ratio of 55 basis points with $341 million in assets under management (AUM). With a daily trading volume of about 123,000 shares, this fund provides adequate liquidity with low a bid-ask ratio and looks better placed than many other funds in this space.

At this time, this ETF is still positioned below its long-term trend line, so more upside momentum is needed to make this a viable alternative.

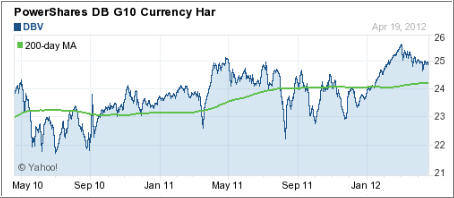

PowerShares DB G10 Currency Harvest Fund (DBV)

Not a strictly short-dollar ETF, this fund tracks the Deutsche Bank G10 Currency Future harvest Index and goes short on currencies from developed nations with lower interest rates and go long on currencies that provide relatively higher yields from the developed markets.

The product has a large short position on the US dollar due to the Fed’s low interest-rate regime and is also short on the Japanese yen and the Swiss Franc.

It’s long on three commodity currencies, namely the antipodean pairs of Australian and New Zealand dollars, and the Norwegian Krone, each having at least 30 percent weighting among the long currencies. Needless to say, it expects the Fed to continue with the low interest rate and loose monetary policy in the foreseeable future and expects the greenback to depreciate.

With total AUM of over $345 million, this ETF charges 75 basis points in fees annually and trades a healthy 170,000 shares daily, denoting healthy liquidity and a small bid-ask spread.

Currently, DBV is positioned above its long term trend line but has come off its high recently.

These ETFs can be highly volatile and, should you decide to seek some exposure, be sure to use my recommended sell stop discipline. These ETFs would fall under sector/country fund category, for which I recommend a 10% trailing sell stop.

Disclosure: No holdings – All charts courtesy of YahooFinance

Contact Ulli