US stocks ended lower Thursday as global growth worries soured investor sentiments with the S&P declining for the third consecutive session. The ever so positive analysts, however, said the markets are taking a breather after recoding double-digit growths in the first quarter.

Treasuries extended gains for the third day after reports showed euro-region output and China’s manufacturing weakened, boosting US debt’s demand.

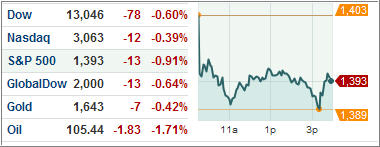

The Dow Jones Industrial Average (DJIA) lost 0.6 percent to settle at 13,046.14. Only eight of the 30-component Dow ended higher with commodities and heavy-equipment manufacturers dropping the most on weak manufacturing data in China and Europe.

The tech-laden NASDAQ Composite (COMP) lost 12 points to settle at 3,063.32, still up more than 17 percent since the beginning of 2012. The number of Americans filing for unemployment claims declined to a four-year low, but was not good enough to shake off the bad mood.

The S&P 500 Index (SPX) shed 0.7 percent to close at 1392.78, with natural resources and the energy sector retreating the most. Consumer staples were the biggest gainer in the 10-sector index. The index closed below the psychological 1,400 level for the first time in more than a week. Is the market choppiness helping volatility-linked ETFs? The answer is both yes and no.

ETFs in the news:

The iPath S&P 500 VIX Short Term Futures ETN (VXX) added 1.2 percent in a choppy market dominated by growth worries in China and Europe. The instrument gained today after recording losses in six previous trading sessions.

As market indices continue to slide, flight of capital to safe-haven assets have started to gather pace. CurrencyShares Japanese Yen Trust (FXY) added 1.0 percent, after weeks of stumbling. If the current downside continues, Japanese yen could display further upside action.

The day’s biggest loser remains Daily 2x VIX Short-Term ETN (TVIX), losing nearly 30 percent on the day. Now this comes as a surprise, since the instrument is a leveraged version of VXX, meaning it was expected to rise some 2 percent on the back of the VXX’s 1 percent gain! You need to exercise caution if trading this ETF, which has given a new meaning to the word volatile.

The iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ) sank 4.3 percent on the day as commodities took a hit across the board today. Energy related products continue to get hammered on weak global growth cues.

The bullion backed ETFS Physical Palladium Shares (PALL) tumbled 4.69 percent, its lowest level since mid-January.

Our Trend Tracking Indexes (TTIs) pulled back but remain entrenched on the bullish side of the trend line by +4.83 percent and +5.99 percent for the Domestic and the International TTI respectively.

Disclosure: No holdings.

Contact Ulli