US stocks retreated Tuesday as China growth worries overpowered upbeat US housing market data. The pullback wasn’t surprising to me; actually it was long overdue, as the indexes had been inching towards historic highs with consecutive gains in the last few sessions.

Today’s (minor) sell off was triggered by falling commodity prices over Chinese growth worries. Copper prices sank 2 percent while oil dropped 2.3 percent on the day. Treasuries moved up, snapping a nine-day losing streak and pushing down 10-year yields from near four-month highs.

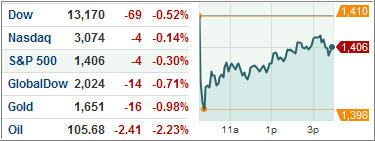

The Dow Jones Industrial Average (DJIA) shed 0.5 percent while the S&P 500 Index (SPX) dropped 0.3 percent, after jumping to a 52-week high yesterday. Industrial and energy stocks fared the worst while financials advanced the most among the 10-sector index.

The tech-heavy NASDAQ Composite (COMP) dropped marginally by 0.1 percent to 3074.15.

For every advancing stock, less than two stocks fell on the NYSE.

The benchmark 10-year Treasuries pushed up, ending the longest streak since 1985. The Fed bought $1.97 billion of Treasuries to keep long-term borrowing costs down, while markets took a break after briefly testing the 2.4 percent level yesterday.

Yields on 10-year maturity notes dropped 0.02 percentage points to end at 2.36 percent and yields on 30-year bonds slipped three basis points to end at 3.44 percent.

ETFs in news

Tiffany jumped 6 percent today over strong sales numbers. This injected some life in retail sector ETFs with the SPDR S&P Retail ETF (XRT) moving 0.64 percent up on the day. The rise of XRT will put questions marks over US consumer spending to rest; at least temporarily.

Market Vectors High Yield Municipal Index ETF (HYD) was among the day’s top gainers adding a modest 0.6 percent, after Treasuries rose today, snapping a 9-day losing streak.

Market Vectors TR Gold Miners (GDX) moved up 0.5 percent despite bullion making losses today.

Among the day’s losers, iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ) tanked a whopping 15.45 percent as investors moved out of market-correlated assets on China fears.

Strangely, the S&P 500 VIX Short-Term Futures ETN (VXX) sank 4.6 percent despite equities retreating today while the Market Vectors Coal ETF (KOL) dropped 2.8 percent as commodity prices eased on China growth worries.

Crude futures for April delivery lost $2.48 to end at $105.61 a barrel and Gold futures for April delivery shed $20.30 to settle at $1,647 an ounce.

In terms of our Trend Tracking Indexes (TTIs), the domestic one hovers now at +4.65 percent above its long term trend line, while its international cousin has shown more short-term momentum at a position of +6.24 percent.

Disclosure: No holdings

Contact Ulli