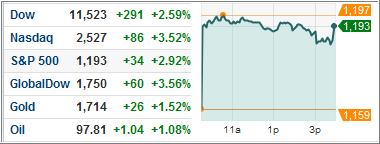

It was a surprisingly joyous day for equity ETFs as global markets rebounded from last week’s rough patch. The S&P 500 roared back, finishing up 2.92% while in Europe, the DAX had a huge day by rising 4.60%. However, the dollar remained at $1.33/Euro.

Regardless, I view today as a mere blip and that market pessimism will soon return. There’s still too much uncertainty to bring markets right back down as we witnessed last week. I mentioned Friday that the possibility of a shift back into rebound mode existed, and that is what happened. The markets were way oversold causing the bounce, which then was supported by short covering as Art Cashin points out in “Sitting on the Edge.”

While markets were in bliss today, the long-term outlook remains dour. Moody’s has not only forecasted a recession scenario in Europe with more ratings downgrades, but a higher probability of multiple countries defaulting that could led to a Eurozone breakup if the debt crisis continues at its current rate. This is not out of the question given the acceleration of contagion as evidenced by skyrocketing bond yields.

Although there have been talks of Italy receiving a bailout, the IMF has declared otherwise for the time being. Nevertheless, Italy is in the doldrums and needs a solution in one form or another considering its unsustainable debt level.

In another hit to Greece’s legitimacy, Greek officials are accusing the head of its statistical agency of inflating the country’s budget deficit figures. It looks like Greece wants protect its interests so as not to reveal the true extent of its deficit, which it has done in the past by fudging figures. It’s clear that Greece is stuck in its irresponsible past ways, making default more likely.

On the global front, the OECD has reduced its growth forecasts for major developed economies. The Eurozone contagion risk is still very high, and the lack of political and economic stability weakens any notion that the world economy will pick up for the foreseeable future.

As far as the U.S. is concerned, there was some optimism due to a 1.3% increase in new home sales. Yet, the median home sales price dropped to its lowest level for the year. With persistent housing weakness, the U.S. economic recovery still has a ways to go.

Despite this euphoria based on new bailout talks, until we see something concrete, there is little reason to believe that there will be a turnaround. As you can see in this morning’s ETF/MF Cutline reports, bond ETFs continue to be attractive such as the iShares Lehman 10-20 Yr Treasury (TLH) and the Vanguard Long-Term Bond (BLV). I want to point out the importance of having a majority bond ETF position amidst the current turmoil.

In regards to trends, our Domestic TTI (Trend Tracking Index), which peeked into bear market territory last Friday (-0.42%), reversed course and has moved back above its long-term trend line by +1.02% for the time being. For how long, that remains the open ended question.

Disclosure: Holdings in TLH

Contact Ulli