- Moving the market

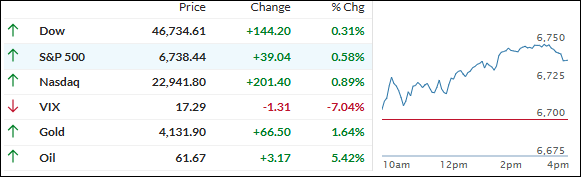

Stocks kicked this session off on a strong note, with major indexes steadily building gains through the session as investor optimism returned to center stage.

Coming off Wednesday’s selling, traders found renewed confidence in tech and industrial names, while upbeat talk around U.S.-China relations and better-than-expected home sales added fuel to the rebound.

Even with tomorrow’s CPI data looming, the mood was decidedly positive. The market shrugged off last night’s headlines and took Treasury Secretary Scott Bessent’s comments on potential export curbs in stride, while confirmation that President Trump’s meeting with China’s Xi Jinping is officially on the calendar helped calm trade nerves.

Tesla shares stayed volatile, dipping after its mixed results but bouncing back by the close, while IBM’s 5% slide reminded investors how unforgiving earnings season can be.

Still, the overall tone was upbeat, with all major asset classes—equities, gold, and even Bitcoin—rising in unison.

The 10-year Treasury yield briefly crossed 4%, and gold climbed back above $4,100 as traders leaned into risk heading into Friday’s inflation print.

With markets choosing to see the glass half full for now, will tomorrow’s CPI keep the rally alive—or snap investors back to reality if inflation proves sticky?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks opened strong today, building on early momentum and extending gains as the session went on. Traders seemed happy to shrug off recent volatility, viewing nearly every headline through a bullish lens—despite knowing that tomorrow’s CPI report could easily shake things up.

The upbeat mood was fueled by optimism around earnings season and signs that underlying demand remains steady across sectors. Even lingering noise around trade and the ongoing government shutdown couldn’t cool the market’s enthusiasm.

Our TTIs marched higher right alongside the indexes, ending the day with moderate gains and signaling that bullish sentiment still has some room to run.

This is how we closed 10/23/2025:

Domestic TTI: +6.91% above its M/A (prior close +6.40%)—Buy signal effective 5/20/25.

International TTI: +11.51% above its M/A (prior close +11.23%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli