- Moving the market

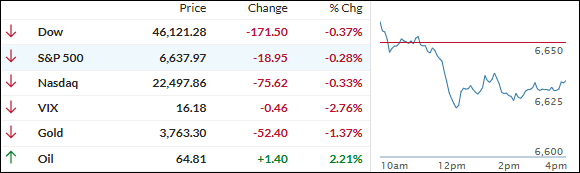

The market couldn’t hold onto early gains today, as pressure on AI heavyweights like Nvidia and Oracle dragged the major indexes into the red for a second straight day.

Nvidia swung around as traders tried to make sense of its new OpenAI partnership, while Micron fell nearly 2% after its earnings and outlook failed to wow anyone. It looks like confidence in the AI trade is still getting tested.

Traders may also be taking profits with valuations high, especially after Powell flagged stretched prices at his press conference.

Add in uncertainty from jobless claims and inflation reports later this week, plus worries about a government shutdown after President Trump nixed a meeting with top congressional Democrats, and it’s no surprise the bulls couldn’t shake off the funk.

Short squeeze attempts flopped, the Mag 7 struggled, and higher yields pushed the dollar up.

Gold finally stumbled after its hot streak, but bitcoin perked up and climbed toward $114k. The real standout was copper, with our ETF zooming almost 4% higher on supply concerns.

So, was today just a healthy pause for the bulls, or is this the start of a bigger shift as the month wraps up?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

An early rally lost steam just as quickly as it arrived, with the major indexes slipping to a red finish by the end of the session.

Our TTIs went along for the ride but ended down less than the broad market—and managed to remain in bullish territory.

This is how we closed 09/24/2025:

Domestic TTI: +5.92% above its M/A (prior close +6.17%)—Buy signal effective 5/20/25.

International TTI: +11.39% above its M/A (prior close +11.63%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli