- Moving the market

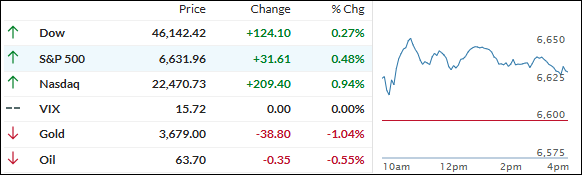

All the major indexes soared to fresh record highs today as traders rotated back into tech stocks, following the Fed’s rate cut and more hints that further cuts are coming this year.

Intel stole the spotlight, popping 26% after Nvidia announced a $5 billion investment and a new partnership on data center and PC products—Nvidia shares jumped over 3% on the news.

Yesterday’s volatility after the Fed’s move settled down, even if Fed Chair Powell was quick to tamp down hopes for an aggressive rate-cutting spree. While policymakers expect two more cuts this year and just one for 2026, traders had hoped for a little more action next year.

It looks like the Fed’s measured approach—cutting 0.25% this week—reflects stubborn inflation and a softer job market. Rather than a pivot, the central bank is clearly choosing “go slow and watch the data.”

The Mag 7 stocks continued to outperform, and heavily shorted names extended their win streak.

Bond yields resumed their climb, helping the dollar to a second straight day of gains. That kept gold flattish, but bitcoin closed at a one-month high north of $118k.

With a massive options expiration on tap tomorrow, will bullish vibes keep powering this run, or are we due for a shake-up?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes got off to a flying start today, notching fresh all-time highs and keeping the bullish vibes going strong right into the close. The rally wasn’t just for show—momentum held steady from open to finish.

Our TTIs were in sync with the broad market, with both advancing. For a change, though, it was the domestic TTI showing more muscle than its international counterpart.

This is how we closed 09/18/2025:

Domestic TTI: +6.86% above its M/A (prior close +6.16%)—Buy signal effective 5/20/25.

International TTI: +11.63% above its M/A (prior close +11.32%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli