- Moving the market

The morning started off mixed as traders waited on the Fed’s policy announcement, and there was no shortage of big headlines.

Nvidia dipped after word got out that China is blocking its chips, while all eyes were on Jerome Powell for clues about the interest rate outlook and the state of the economy.

As expected, the Fed cut rates by 0.25% and signaled two more cuts may be on deck this year. Powell called it a “risk management” move, but confusion set in after the Fed also raised its growth and inflation forecasts—that cocktail left traders with more questions than answers.

Only the Dow managed to end in the green, while the S&P and Nasdaq lost ground. Bond yields and the dollar whipped around, and gold gave back some recent gains after a wild ride. Bitcoin had a volatile day too, recovering a bit before settling lower.

So, with the Fed now officially back in easing mode, will easier money keep the bulls in charge from here—or does the mixed outlook mean more sideways action ahead?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

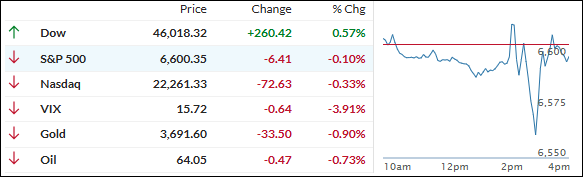

The Dow stood out as the only major index to finish higher today, shrugging off some confusing signals after the Fed delivered the expected 0.25% rate cut and hinted at more to come later this year.

The S&P 500 and Nasdaq, on the other hand, lost steam and closed moderately lower as traders digested the mixed messages from Powell and company.

Our TTIs mostly moved in sync with the market but didn’t show much change when the dust settled.

This is how we closed 09/17/2025:

Domestic TTI: +6.16% above its M/A (prior close +6.06%)—Buy signal effective 5/20/25.

International TTI: +11.32% above its M/A (prior close +11.40%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli