- Moving the market

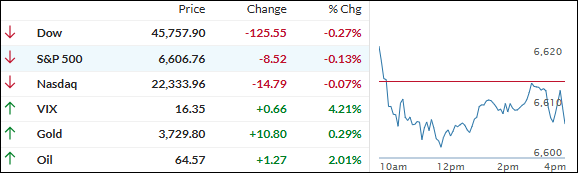

Stocks wobbled this morning as traders kept one eye on the Fed meeting and the other on fresh headlines from the U.S.-China trade front.

Oracle stood out, climbing 4% after word got out the company will help keep TikTok running in the U.S. as part of a newly confirmed “trusted technology provider” partnership.

The deal came together after U.S. and Chinese officials wrapped up two days of talks and struck a “framework” agreement for TikTok, just ahead of the divest-or-shut-down deadline. Treasury Secretary Bessent said the tone was positive and that China now senses a broader trade deal may be possible.

Meanwhile, the Fed’s big decision is just a day away, with markets fully expecting at least a quarter-point rate cut. Still, traders will be listening closely to Jerome Powell’s press conference for any hints on what comes next.

Economic data was a mixed bag: strong retail sales and factory output, but import/export prices were all over the place and homebuilder sentiment stayed weak, leaving the indexes moderately in the red by the close.

Mag 7 stocks again outperformed, gold smashed through $3,700 to a new high as the dollar slid, and bitcoin ripped higher before hitting resistance.

So, with the Fed in the hot seat, will a rate cut tomorrow put wind in the market’s sails—or will investors keep treading water?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Equities showed some early life but drifted sideways for most of the day, with all the major indexes finishing slightly in the red as nerves set in ahead of tomorrow’s much-anticipated Fed rate announcement.

With everyone waiting to see how the central bank moves on rates, it’s no surprise the bulls took a breather and let the market coast.

Our TTIs split again—domestic dipped a bit, international managed a small gain—but neither was enough to shift the overall outlook in any significant way.

This is how we closed 09/16/2025:

Domestic TTI: +6.06% above its M/A (prior close +6.34%)—Buy signal effective 5/20/25.

International TTI: +11.40% above its M/A (prior close +11.31%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli