- Moving the market

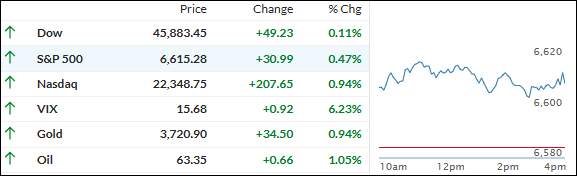

The major indexes tried to add to last week’s gains today, driven by upbeat headlines from the latest U.S.-China trade talks and traders bracing for the Fed’s big meeting on rates.

Both the S&P 500 and Nasdaq even climbed to new record highs, powered by strong showings in the tech sector and hints from President Trump that discussions with China were “going well.”

U.S. and Chinese officials wrapped up another round of talks, working through tariffs and the TikTok deadline. Trump’s social media post echoed optimism on progress, but he warned that the U.S. could still push ahead with a TikTok ban if China keeps pressing for tariff relief and tech concessions.

Meanwhile, China’s regulator took aim at Nvidia over antitrust concerns, sending shares down nearly 2%. On the flip side, Tesla popped 7% after Elon Musk revealed his biggest-ever open market stock buy.

Today’s action followed a week of softer labor market data and calm inflation, helping fuel hopes for a Fed rate cut Wednesday. Futures markets now put the odds at 96% for a quarter-point cut, while the odds for a bigger move have faded fast.

Bond yields slipped, the dollar hit a two-month low, and the Mag 7 extended their lead over the rest of the market—highlighting how the rally is anything but broad-based.

Gold notched another record close, running with global liquidity, while bitcoin gave back recent gains.

With retail sales on tap tomorrow and the Fed on deck Wednesday, is Wall Street about to get another dose of “buy the rumor, sell the fact?”

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The indexes kicked off the day with some real energy and managed to hang onto those gains all session—thanks mostly to a tech sector that refused to quit.

The catch? The rally wasn’t exactly a team effort, with tech doing all the heavy lifting while other sectors mostly coasted.

Because the gains were so narrowly focused, our domestic TTI ended up flat, while the international TTI showed some momentum and closed nicely in the green.

This is how we closed 09/15/2025:

Domestic TTI: +6.34% above its M/A (prior close +6.53%)—Buy signal effective 5/20/25.

International TTI: +11.31% above its M/A (prior close +10.91%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli