- Moving the market

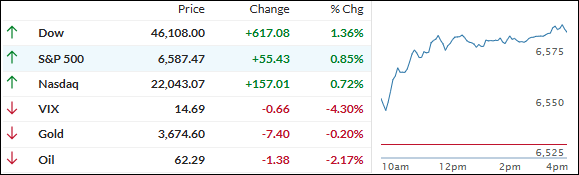

Stocks shot higher this morning as traders cheered the latest inflation data, hoping the numbers wouldn’t get in the way of a long-awaited Fed rate cut next week.

All three major indexes notched new all-time highs during the session, thanks in part to a hefty short-squeeze that sent the bears running.

The CPI report was a bit of a head-scratcher: monthly inflation ran a touch hotter than hoped, up 0.4%, but annual inflation landed right in line at 2.9%. Core CPI—excluding food and energy—looked steady, also meeting forecasts.

Still, with the jobs market flashing some cracks and weekly jobless claims jumping to the highest point since 2021, investors are convinced the Fed will be forced to cut rates, maybe even by more than a quarter-point.

Bond yields tumbled on the news, the dollar sold off, and bitcoin built on its recent run. Gold took a breather after its hot streak, digesting its latest gains.

So, with inflation nerves mostly calm for now, will the Fed’s next move keep this rally rolling, or will another surprise knock things off course?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Consumer prices came in right on target, with no sign of runaway inflation or tariff-driven surprises, which was exactly what traders wanted to see.

That gave both stocks and algorithms the green light, and the major indexes put up solid gains together, with the Dow leading the charge by the close.

I think today’s inflation print was enough to ease some nerves on Wall Street, and our TTIs responded accordingly—both advanced strongly as bullish momentum returned.

This is how we closed 09/11/2025:

Domestic TTI: +7.45% above its M/A (prior close +5.86%)—Buy signal effective 5/20/25.

International TTI: +11.57% above its M/A (prior close +10.67%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli