- Moving the market

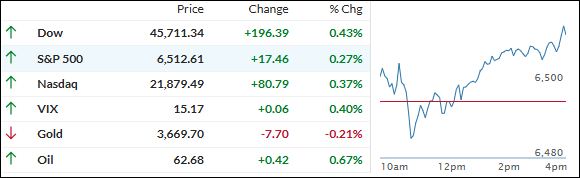

The push to extend yesterday’s rally sputtered out pretty quickly today. After some early enthusiasm, the major indexes slipped back and mostly hovered near unchanged before managing to eke out modest gains by the closing bell.

The big news from the Labor Department was a huge revision to last year’s job growth—turns out they overestimated by 911,000 jobs.

Since the report covers data from six months back, most traders shrugged it off for now, but it definitely plays into the broader narrative: expectations for Fed rate cuts this year keep getting stronger, and many seem to be rooting for a bigger move when the Fed meets next week.

It’s clear the jobs picture keeps softening, which could grease the wheels for rate cuts—but it also raises real questions about whether stocks have come too far, too fast.

The next wild card will be this week’s pair of inflation reports. If the numbers come in hot, the familiar threat of “stagflation” comes right back into focus, possibly forcing the Fed’s hand in the opposite direction.

Mag 7 stocks outperformed again, with Apple as a laggard. Bond yields pushed higher on inflation jitters, sending gold to a sharp intraday high before it reversed course in the afternoon.

Bitcoin saw a classic “pump and dump,” undoing its early gains as the dollar gained steam and finished higher.

So, with all eyes now on the inflation data, the big question is: will we see another leg up for equities, or does the slowdown in jobs and sticky inflation finally bring this rally to a halt?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Even though things got off to a sluggish start, the bulls stepped in and pushed the major indexes into the green by the close—a nice lift just ahead of those highly anticipated inflation numbers.

Our TTIs painted a mixed picture. The domestic TTI slipped again, while the international one managed a small gain, suggesting markets abroad are finding their groove even as things at home remain a bit soft.

This is how we closed 09/09/2025:

Domestic TTI: +5.97% above its M/A (prior close +6.29%)—Buy signal effective 5/20/25.

International TTI: +10.07% above its M/A (prior close +9.96%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli