- Moving the market

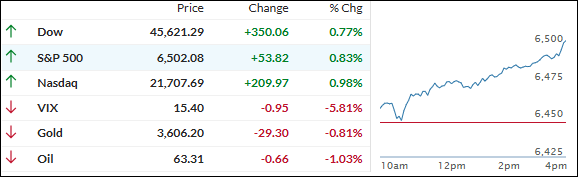

Wall Street got a confidence boost today, thanks to softer private payroll numbers that put a Fed rate cut squarely back on the table.

The S&P 500 hit another record close, Small Caps outperformed, and the Nasdaq joined the ride higher, even as the Dow lagged. I think traders saw the ADP miss—not terrible, but not strong—as a “just right” signal: weak enough to keep the Fed dovish, but not so bad as to spook anyone about a recession.

The way I see it, there’s a Goldilocks vibe in the air. With jobless claims up a bit and the odds of a September rate cut now near 98%, market focus has already shifted to Friday’s big jobs report.

On the Washington front, tariff headlines are swirling again as President Trump asked the Supreme Court to reverse lower court rulings against his tariffs, adding a touch more uncertainty to the mix.

Bond yields eased back as a result, and the dollar bounced after yesterday’s slide.

Surprisingly, gold took a breather—ending a winning streak and closing in the red for the first time in eight sessions—while bitcoin dropped but managed to find some buyers around the $110k mark.

As for the Mag 7 stocks, they mostly rode the bullish wave, helping lift the overall tech sector even as the rest of the market looked for direction.

I believe the key now is whether tomorrow’s jobs data can keep this “good news is good, but not too good” recipe intact.

Will a Goldilocks jobs number keep risk assets rolling, or are we setting up for some fresh volatility?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Today felt like a proper reversal, with the major indexes bouncing back nicely while yesterday’s big winners—precious metals—ran out of steam and slid into the red.

The way I see it, a little mean reversion was overdue after recent moves, and stocks used the opportunity to turn the tide.

Our TTIs followed suit, shaking off Wednesday’s drop to finish the session in positive territory.

This is how we closed 09/04/2025:

Domestic TTI: +6.34% above its M/A (prior close +5.56%)—Buy signal effective 5/20/25.

International TTI: +9.65% above its M/A (prior close +8.91%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli