- Moving the market

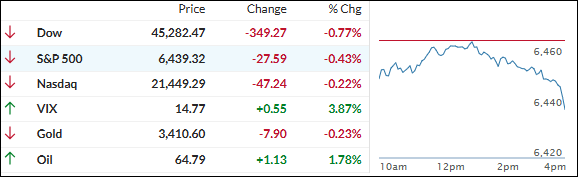

After last week’s big Fed-driven rally, traders started the week on a more cautious note. The major indexes slipped today, with the Dow falling about 0.7%, the S&P 500 down 0.4%, and the Nasdaq in the red by -0.2%.

I believe this minor retreat was mainly due to profit-taking and a bit of hesitation as investors wait for several key economic reports and Nvidia’s highly anticipated earnings coming up.

Surprisingly, the excitement around a potential September rate cut after Powell’s dovish Jackson Hole speech seems to be cooling off for now. Bond yields inched upward as some of that Fed-fueled euphoria faded and traders refocused on issues like tariffs and inflation’s impact on corporate profits. A surging dollar also weighed on risk assets.

For the “Mag 7” tech stocks, Nvidia led the charge today with a nearly 2% gain, while other names like Microsoft, Alphabet, and Tesla posted mixed results, reflecting persistent questions about valuations and the AI boom’s staying power. Financials and materials were laggards, while small caps dipped after Friday’s surge.

Gold continued to drift sideways, holding steady as investors seemed content to wait for clearer signals from the Fed, while bitcoin slipped, lacking any major catalysts to spark a move.

It’s my view that today’s pullback is just a pause after Friday’s celebration. The market is still driven by rate cut hopes and the performance of mega cap tech, but with volatility likely this week as earnings and inflation data roll in.

So, the question is: Will Nvidia’s results, and economic data, reignite the rally, or could we see more sideways action until the Fed’s next move?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The market kicked off the session on a weak note, with all the indexes heading lower out of the gate.

The Nasdaq managed to poke above its starting point for a bit, but eventually got dragged down too as sellers took charge. The way I see it, today was very much a “give-back” day after Friday’s strong finish.

Our TTIs reflected that mood—they both slipped, handing back some of their gains from last week and following the broader market’s downward drift.

Please note that Friday’s TTI calculations contained an error, which has been corrected today. Sorry for the mishap.

This is how we closed 08/25/2025:

Domestic TTI: +6.29% above its M/A (prior close +5.06%)—Buy signal effective 5/20/25.

International TTI: +10.33% above its M/A (prior close +9.33%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli