- Moving the market

The market was a mixed bag at the open, with the Dow standing out while everyone else treaded water as traders digested new earnings from major retailers and looked ahead to Fed Chair Jerome Powell’s much-anticipated speech later this week.

Home Depot shares popped 2%—even though its second-quarter results missed expectations, investors were happy the company left its full-year outlook unchanged.

The rest of the retail crew—Lowe’s, Walmart, and Target—are in the spotlight as earnings continue to roll in, with investors eager for any clues about the health of the U.S. consumer, especially with inflation and trade policy still in flux.

The real buzz, though, is all about the Fed’s annual Jackson Hole gathering. There’s plenty of wishful thinking that Powell’s Friday speech could be a game changer, with many hoping he’ll hint at a rate cut for September.

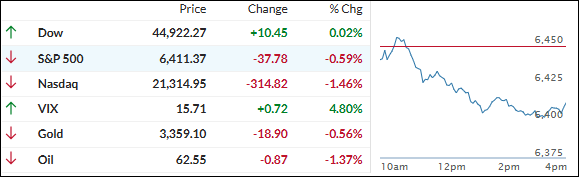

Despite the early promise, tech stocks weighed heavily on the indexes, and everything finished in the red.

The Dow has actually been beating the Nasdaq for four of the last five days—a trend mirrored by the Mag7 stocks, which have pulled back sharply this week. The most shorted stocks got slammed.

The dollar bounced back after some ups and downs, bond yields dipped, gold slipped for a fourth straight session, and bitcoin fell toward three-week lows after last week’s fireworks.

With everyone now hanging on Powell’s upcoming words, will he deliver the bullish news traders are hoping for, or will the bears get the upper hand?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

It was another wishy-washy day on Wall Street, with the market unable to pick a direction.

With no strong momentum, stocks took the easy way out and drifted lower—except for the Dow, which barely managed to squeeze out a small gain.

Interestingly, our TTIs bucked the trend and finished moderately higher, underscoring just how much tech stocks struggled compared to the rest of the market.

This is how we closed 08/19/2025:

Domestic TTI: +5.62% above its M/A (prior close +5.13%)—Buy signal effective 5/20/25.

International TTI: +10.20% above its M/A (prior close +10.07%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli